Apple (NASDAQ:AAPL) currently tops the list of the largest companies in the world. Microsoft (NASDAQ:MSFT) and Nvidia (NASDAQ:NVDA) round out the top three.

Eight of the largest companies have a market cap of at least $1 trillion. While tech companies dominate the top of the stock market, there are other sectors represented, including oil, insurance, medical companies, and financial services. Read on to see the 20 most valuable companies and where they stand as of April 2025.

Largest companies by market cap

Largest companies by market cap

| Name and ticker | Market cap | Current price | Sector |

|---|---|---|---|

| Apple (NASDAQ:AAPL) | $2.9 trillion | $194.42 | Information Technology |

| Microsoft (NASDAQ:MSFT) | $2.8 trillion | $371.56 | Information Technology |

| Nvidia (NASDAQ:NVDA) | $2.5 trillion | $104.31 | Information Technology |

| Amazon (NASDAQ:AMZN) | $1.9 trillion | $174.96 | Consumer Discretionary |

| Alphabet (NASDAQ:GOOG) | $1.9 trillion | $155.63 | Communication Services |

| Meta Platforms (NASDAQ:META) | $1.3 trillion | $503.04 | Communication Services |

| Berkshire Hathaway (NYSE:BRK.A) | $1.1 trillion | $771,403.96 | Financials |

| Taiwan Semiconductor Manufacturing (NYSE:TSM) | $787 billion | $151.68 | Information Technology |

| Tesla (NASDAQ:TSLA) | $777 billion | $241.26 | Consumer Discretionary |

| Broadcom (NASDAQ:AVGO) | $821 billion | $174.83 | Information Technology |

| Eli Lilly (NYSE:LLY) | $697 billion | $734.92 | Health Care |

| Walmart (NYSE:WMT) | $731 billion | $91.20 | Consumer Staples |

| JPMorgan Chase (NYSE:JPM) | $639 billion | $229.70 | Financials |

| Visa (NYSE:V) | $647 billion | $331.35 | Information Technology |

| Tencent (OTC:TCEHY) | $527 billion | $57.80 | Communication Services |

| ExxonMobil (NYSE:XOM) | $451 billion | $104.17 | Energy |

| Mastercard (NYSE:MA) | $468 billion | $513.98 | Information Technology |

| UnitedHealth Group (NYSE:UNH) | $535 billion | $585.37 | Health Care |

| Costco Wholesale (NASDAQ:COST) | $429 billion | $969.32 | Consumer Staples |

Companies 1-5

1. Apple

- Market cap: $3.27 trillion (as of April 1)

- Revenue (TTM): $395.8 billion

- Gross profit (TTM): $184.1 billion

- Five-year annualized return: 29.34%

- Year founded: 1976

Tech giant Apple is proof of how far high-quality products and strong brand loyalty can go. It first became the world's most valuable company on Aug. 9, 2011, just 15 days before Steve Jobs resigned as CEO. It also holds the distinction of being the first company to hit market caps of $1 trillion, $2 trillion, and $3 trillion.

Apple built its success off sales of its wildly popular products, including the iPhone, MacBook, and AirPods. It has branched out into services, including its Apple TV+ streaming service. And it's developing Apple Intelligence, an artificial intelligence (AI) technology, although the rollout of new features has been slower than anticipated.

On a negative note, the U.S. Department of Justice filed an antitrust lawsuit against Apple in March 2024. It alleges that Apple illegally maintains a monopoly over smartphones through contractual restrictions on developers. Apple has filed a motion to have the lawsuit dismissed.

2. Microsoft

- Market cap: $2.82 trillion (as of April 1)

- Revenue (TTM): $261.8 billion

- Gross profit (TTM): $181.7 billion

- Five-year annualized return: 21.44%

- Year founded: 1975

Considering the popularity of the Windows operating system, it’s no surprise that Microsoft has consistently ranked as one of the largest companies in the world. Over 70% of computers use Windows, according to Statcounter. While it's most famous for Windows, Microsoft also has a diverse selection of products and services that has helped to build on its success, including:

- Office Suite software

- Azure cloud platform

- Xbox video game consoles

- Surface computer and tablets

Microsoft has been making a big push into AI technology. It launched an AI-powered digital assistance, Microsoft Copilot. It's also planning to invest $80 billion in AI-enabled data centers during the 2025 fiscal year, and it's partnered with OpenAI, the developer of ChatGPT.

3. Nvidia

- Market cap: $2.68 trillion (as of April 1)

- Revenue (TTM): $130.5 billion

- Gross profit (TTM): $97.9 billion

- Five-year annualized return: 76.99%

- Year founded: 1993

Tech company Nvidia designs and develops graphics processing units (GPUs) originally used for PC graphics and video games. Its GPUs are in high demand because they play a key role in training and operating AI applications. They've also been used for mining cryptocurrency (using computer processing power to validate crypto transactions and earn rewards)

Because of the AI boom, Nvidia was unstoppable in 2024, when it added over $2 trillion to its market cap. It has been the world's largest company several times, including earlier this year. However, news of Chinese AI company DeepSeek then caused its value to drop by $589 billion in a single day, the largest one-day loss in Wall Street history.

4. Amazon

- Market cap: $2.04 trillion (as of April 1)

- Revenue (TTM): $638.0 billion

- Gross profit (TTM): $307.3 billion

- Five-year annualized return: 15.18%

- Year founded: 1994

E-commerce leader Amazon started out as an online bookstore, which goes to show just how much its reach has expanded. It's now the site where you can buy practically anything, and it’s the largest online retailer in the world.

The company’s Amazon Prime service has more than 200 million users worldwide. It's also the largest cloud provider in the world with Amazon Web Services (AWS). And that's only the tip of the iceberg. Amazon also has its Amazon Prime Video streaming service and video game streaming through Twitch, plus it owns the Whole Foods Market grocery chain.

Yet it isn't all good news. The Federal Trade Commission (FTC) and 17 states filed an antitrust lawsuit against Amazon in September 2023 alleging that Amazon is a monopoly that uses anti-competitive practices to maintain its position. While the lawsuit is ongoing, Amazon won a partial dismissal in a September 2024 ruling.

5. Alphabet (Google)

- Market cap: $1.90 trillion (as of April 1)

- Revenue (TTM): $349.8 billion

- Gross profit (TTM): $203.8 billion

- Five-year annualized return: 23.04%

- Year founded: 1998 (Google), 2015 (Alphabet)

Alphabet is the holding company created through a restructuring of Google in 2015. Of course, Google is most well-known as a search engine, becoming so famous that the name is synonymous with online searches. That's just one of Alphabet’s many widely used products, which also include:

- Email service Gmail

- Video site YouTube

- Navigation apps Waze and Maps

- Pixel smartphones

Google's dominance over online searches hasn't been without controversy, as Alphabet has been embroiled in antitrust lawsuits. In August 2024, a judge found that Google acted illegally to monopolize online search and advertising. The court hasn't decided on penalties yet, and Alphabet plans to appeal the ruling.

Companies 6-10

6. Saudi Arabian Oil

- Market cap: $1.72 trillion* (as of April 1)

- Revenue (TTM): $480.3 billion*

- Gross profit (TTM): $234.1 billion*

- Year founded: 1933

*Converted from Saudi riyals.

Saudi Arabian Oil, also known as Saudi Aramco, is an energy and chemicals company. Owned by the Saudi Arabian government, it has the largest daily oil production and the second-largest proven crude oil reserves of all oil companies.

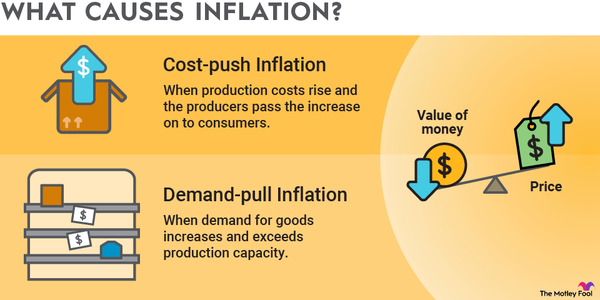

Since Saudi Aramco is largely dependent on oil prices, it can go through significant ups and downs. Heavy oil demand helped it claim the top spot in terms of market cap early in May of 2022, but when demand fell, it was surpassed again. To diversify its portfolio, Saudi Aramco invested $500 million in a liquified natural gas (LNG) company, MidOcean Energy, in September 2023.

7. Meta Platforms

- Market cap: $1.46 trillion (as of April 1)

- Revenue (TTM): $164.5 billion

- Gross profit (TTM): $134.3 billion

- Five-year annualized return: 29.84%

- Year founded: 2004

The company formerly known as Facebook rebranded in 2021 and announced a new focus on building the metaverse. It's also investing heavily into AI. For now, Meta Platform's biggest products are its social networks, Facebook, and Instagram.

It also owns WhatsApp and Messenger, and it expanded into virtual reality with its Meta Quest 3 and its acquisition of Oculus. Meta makes the vast majority of its money from advertising, which accounts for over 98% of its revenue.

8. Berkshire Hathaway

- Market cap: $1.14 trillion (as of April 1)

- Revenue (TTM): $371.4 billion

- Gross profit (TTM): $66.2 billion

- Five-year annualized return: 24.10%

- Year founded: 1839

Berkshire Hathaway is the first U.S. company outside of the tech sector to have a $1 trillion market cap. It started out as a textile company and remained in that business for more than a century, but it's now known for its ties to legendary investor Warren Buffett. He began investing in Berkshire in 1962, and he took majority control in 1965.

Buffett has acted as chairman and CEO since then and converted Berkshire to a holding company in 1970. Charlie Munger served as vice chairman from 1978 until his passing in late 2023. While Berkshire's main business is insurance (it owns one of the largest insurance companies, GEICO), Berkshire has also invested in companies across a range of industries.

9. Taiwan Semiconductor Manufacturing

- Market cap: $856.97 billion (as of April 1)

- Revenue (TTM): $87.2 billion*

- Gross profit (TTM): $48.1 billion*

- Five-year annualized return: 30.95%

- Year founded: 1987

*Converted from New Taiwan dollars.

Taiwan Semiconductor Manufacturing, also known as TSMC, is a leader in semiconductor production and is Taiwan's most valuable company. As such, it works with many of the leading global technology companies, including Apple and Nvidia. It's another of the tech companies benefiting from the growth of AI. It's the largest contract chip manufacturer in the world, and demand for AI chips has led to increased sales for TSMC.

10. Tesla

- Market cap: $847.71 billion (as of April 1)

- Revenue (TTM): $97.7 billion

- Gross profit (TTM): $17.4 billion

- Five-year annualized return: 50.29%

- Year founded: 2003

Electric vehicles (EVs) are growing in popularity, and no company has been riding that wave more than Tesla. It's the most valuable automaker in the world. The Tesla Model Y was the world's best-selling car in 2023 and 2024. The Cybertruck, which was released in 2023, has also become one of the most popular EVs in the country.

Tesla is most famous for its vehicles, and it's second only to China's BYD Company (OTC:BYDDY) among the largest EV companies in terms of manufacturing. That's not all it has to offer, though. In addition to EVs, Tesla also manufactures solar roofs, solar panels, and Powerwall, an integrated battery system that stores solar energy.

Tesla has had a turbulent 2025 so far. Co-founder and CEO Elon Musk's entry into politics has led to backlash against the automaker in the form of boycotts and even vandalism of Tesla vehicles.

Companies 11-15

11. Broadcom

- Market cap: $795.19 billion (as of April 1)

- Revenue (TTM): $54.5 billion

- Gross profit (TTM): $34.5 billion

- Five-year annualized return: 52.73%

- Year founded: 1961 (HP Associates), 2005 (Avago Technologies), 2016 (Broadcom Limited)

Broadcom started out as HP Associates, the semiconductor division of HP (NYSE:HPQ). It's now one of the largest semiconductor companies. Broadcom has also expanded into software with an acquisition of VMware that was completed in November 2023.

12. Eli Lilly

- Market cap: $779.73 billion (as of April 1)

- Revenue (TTM): $45.0 billion

- Gross profit (TTM): $36.8 billion

- Five-year annualized return: 45.44%

- Year founded: 1876

Founded by a chemist and Union Army veteran of the same name, Eli Lilly is one of the world's largest pharmaceutical companies. It was the first company to mass-produce insulin and the polio vaccine.

Eli Lilly's main revenue drivers are diabetes drugs and weight loss medication, specifically Mounjaro and Zepbound. It also manufactures antidepressants, most notably Prozac, and donanemab, a treatment for Alzheimer's disease.

13. Walmart

- Market cap: $703.80 billion (as of April 1)

- Revenue (TTM): $681.0 billion

- Gross profit (TTM): $169.2 billion

- Five-year annualized return: 20.17%

- Year founded: 1962

Walmart may not have the largest market cap, but it is No. 1 in terms of revenue, and it’s the largest retailer in the world. With more than $600 billion in annual revenue, it earns more than most of the other companies on this list by a wide margin.

14. JPMorgan Chase

- Market cap: $679.04 billion (as of April 1)

- Revenue (TTM): $177.4 billion

- Gross Profit (TTM): $177.4 billion

- Five-year annualized return: 25.16%

- Year founded: 1799 (Bank of the Manhattan Company), 2000 (merger of JPMorgan and Chase)

While there are several big banks in the U.S., JPMorgan Chase is the biggest. It managed $4.00 trillion in assets at the end of 2024, more than any other U.S. bank and the fifth-highest in the world.

15. Visa

- Market cap: $669.78 billion (as of April 1)

- Revenue (TTM): $36.8 billion

- Gross profit (TTM): $29.4 billion

- Five-year annualized return: 17.05%

- Year founded: 1958

Visa is the most widespread payment network in the world, and it processes transactions for prepaid cards, debit cards, and credit cards. It's accepted in over 130-million merchant locations across more than 200 countries and territories, and it reported $13.2 trillion in payments volume in its 2024 fiscal year.

The U.S. Department of Justice filed an antitrust lawsuit against Visa in September 2024. It alleges that Visa operates an illegal monopoly over the debit card payments market. Visa is contesting the lawsuit.

Companies 16-20

16. Tencent

- Market cap: $590.18billion (as of April 1)

- Revenue (TTM): $88.6 billion*

- Gross profit (TTM): $46.3 billion*

- Five-year annualized return: 7.85%

- Year founded: 1998

*Converted from Chinese yuan.

Tencent is an internet and technology company, and it's the most valuable publicly traded company in China. It's known for its communication services, including the WeChat app, as well as for publishing video games and other digital content. In March 2025, Tencent acquired a 25% stake in a new subsidiary of gaming company Ubisoft Entertainment (OTC:UBSFY).

17. ExxonMobil

- Market cap: $510.85 billion (as of April 1)

- Revenue (TTM): $339.2 billion

- Gross profit (TTM): $76.7 billion

- Five-year annualized return: 32.17%

- Year founded: 1882 (Standard Oil of New Jersey), 1999 (merger of Exxon and Mobil)

As recently as 2013, ExxonMobil was the largest company by market cap. However, environmental disasters and a long history of climate change denial led to heavy criticism of the oil company. Although ExxonMobil is still a leader in terms of revenue, its market cap has been stuck in neutral for the past decade.

18. Mastercard

- Market cap: $492.88 billion (as of April 1)

- Revenue (TTM): $28.2 billion

- Gross profit (TTM): $21.5 billion

- Five-year annualized return: 17.54%

- Year founded: 1966

Mastercard has long been Visa's closest competitor among payment networks. In 2024, it processed a gross dollar volume of $9.8 trillion in transactions.

19. UnitedHealth Group

- Market cap: $472.03 billion (as of April 1)

- Revenue (TTM): $396.6 billion

- Gross profit (TTM): $85.7 billion

- Five-year annualized return: 18.01%

- Year founded: 1977

UnitedHealth Group is a healthcare and insurance company. It operates two main businesses: UnitedHealthcare and Optum. UnitedHealthcare offers employer and individual, Medicare and retirement, community and state, and global health insurance. Optum provides healthcare services, analytics, and pharmacy care services.

Last year was a turbulent one for UnitedHealth Group. In February 2024, it disclosed that a subsidiary, Change Healthcare, was the victim of a cyberattack. It ended up being the largest reported healthcare data breach in history, resulting in the compromised data of at least 100 million people.

20. Costco

- Market cap: $412.47 billion (as of April 1)

- Revenue (TTM): $264.1 billion

- Gross profit (TTM): $35.1 billion

- Five-year annualized return: 28.83%

- Year founded: 1983

With over 130 million members, Costco is the largest warehouse club in the U.S. Costco has a unique business model where it generates a large portion of its profits from membership fees, allowing it to offer high-quality products with a low markup.

Takeaways

Takeaways for investors

Large-cap stocks like these are an important part of every investor's portfolio. They generally provide more safety and stability than smaller stocks since most of them are established companies with strong brands.

They can be highly profitable as well; 17 of the stocks on this list outperformed the S&P 500 over the past five years. Tech companies, in particular, can often be profitable investments. They make up the top five -- and seven of the top 10 -- largest companies by market cap.

Yet even with the biggest companies in the world, no investment is a sure thing. A diversified portfolio is still a must so that you're not overly reliant on any single company or market sector.

Sources

- JPMorgan Chase & Co. (2025). "Fourth-Quarter 2024 Results."

- Mastercard (2025). "Mastercard Incorporated Reports Fourth Quarter and Full Year 2024 Financial Results."

- Meta (2024). "Meta Reports Fourth Quarter and Full Year 2024 Results."

- Statcounter GlobalStats (2024). "Desktop Operating System Market Share Worldwide."

- Techjury (2023). "15 Amazon Prime Statistics to Show How Big It Is In 2023."

- Visa (2024). "Annual Report 2024."