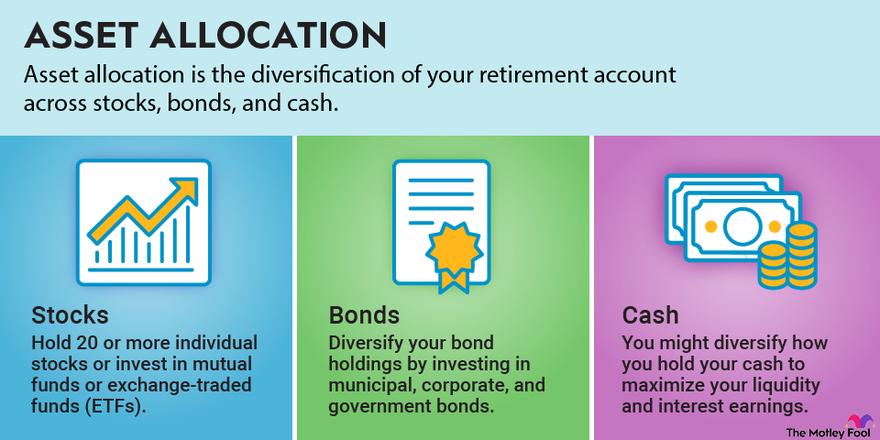

Asset allocation is the diversification of your retirement account across stocks, bonds, and cash. Your age is a primary consideration when you're managing allocation because the older you are, the less investment risk you can afford to take. As you get closer to retirement age, your risk tolerance decreases dramatically, and you can't afford any wild swings in the stock market.

Save those wild rides for the amusement park. You can safely increase your wealth over time and meet your retirement goals by following these five best practices for managing your asset allocation.

1. Asset allocation by age

1. Adjust your asset allocation according to your age

When your investment timeline is short, market corrections are especially problematic -- both emotionally and financially. Emotionally, your stress level spikes because you had plans to use that money soon, and now some of it is gone. You might even get spooked and sell. And financially, selling your stocks at the bottom of the market locks in your losses and puts you at risk of missing the stocks' potential recovery.

Adjusting your allocation according to your age helps you to bypass those problems. For example:

- You can keep more money in stocks if you're younger. You have plenty of years until you reach retirement and can ride out any current market turbulence.

- As you get older, it's wise to gradually start shifting money out of stocks and into bonds and other fixed-income instruments.

- Once you're retired, an even more conservative asset allocation could make the most sense. We'll get into some ways to determine your ideal asset allocation in the next section.

- Hold any money you'll need within the next five years in savings accounts, CDs, Treasury bonds, or other safe investments.

- Keep your emergency fund entirely in a savings account. As is the nature of emergencies, you may need access to this money with just a moment's notice.

Asset

2. Rule of 110

2. Find your ideal asset allocation by age

One rule of thumb financial planners often use is known as the Rule of 110. In a nutshell, this says that by subtracting your age from 110, you can determine approximately what percent of your portfolio should be in stocks or stock-based funds. The rest belongs in bonds and other fixed-income investments.

For example, if you're 40 years old, this rule implies that you should have about 70% of your portfolio in stocks, with the rest in fixed income.

Keep in mind that this rule aims to determine your ideal asset allocation solely by your age. However, every person is different. You can adjust the percentages higher or lower to compensate for your own risk tolerance, your desired retirement age, and other factors. can be just as important. Ultimately, the way you allocate your investment portfolio should provide you with peace of mind, regardless of your age.

3. Stock market conditions

3. Don't let stock market conditions dictate your allocation strategy

When the economy is performing well, it's tempting to believe that the stock market will continue to rise forever, and that belief may encourage you to chase higher profits by holding more stocks. This is a mistake. Follow a planned asset allocation strategy precisely because you can't time the market and don't know when a correction is coming. If you let market conditions influence your allocation strategy, then you're not actually following a strategy.

4. Diversification

4. Diversify your holdings within each asset class

Diversifying across stocks, bonds, and cash is important, but you should also diversify within these asset classes. Here are some rules of thumb to help you do that:

Stocks:

Investing in individual stocks isn't right for everybody. But if you choose to go this route, it's wise to hold 20 or more individual stocks to prevent relying too much on any single investment's performance. Alternatively, you can invest in mutual funds or exchange-traded funds (ETFs).

You can diversify your stock holdings by individual company and market sector. Utility companies, consumer staples, and healthcare companies tend to be more stable, while the technology and financial sectors are more reactive to economic cycles.

Mutual funds and ETFs are already diversified, and that's especially true when it comes to index funds that track broad indexes like the S&P 500.

Bonds:

Buying individual bonds can be a clunky and complex process. For most investors, the best way to go is investing in bond funds. The different types of bonds available are primarily municipal, corporate, and government bonds. There are excellent low-cost index funds for each type.

Cash:

Cash doesn't lose value like a stock or bond can, so diversifying your cash holdings doesn't necessarily need to be a priority. And to be clear, by "cash," we mean a savings account or CD, not physical cash.

If you have lots of cash, you might hold it in separate banks so that all of it is FDIC-insured. The FDIC limit is typically $250,000 per depositor, per bank.

One smart strategy is to diversify how you hold your cash to maximize your liquidity and interest earnings. For example, you could hold some cash in a liquid savings account and the rest in a less-liquid certificate of deposit (CD) with a higher interest rate than a standard savings account.

5. Target-date funds

5. Invest in a target-date fund that manages asset allocation for you

If you're nodding off just reading about asset allocation, there is another option. You could invest in a target-date fund, which manages asset allocation for you. A target-date fund is a mutual fund or ETF that gradually moves toward a more conservative allocation as the target date approaches.

The target date is referenced in the fund's name and denotes the year that you plan to retire. A 2055 fund, for example, is designed for folks who plan to retire in 2055.

Target-date funds generally follow asset allocation best practices. They're diversified across and within asset classes, and the allocation takes your age into account. These funds are also easy to own. You personally don't have to actively manage your allocation or even hold any other assets -- except for the cash in your emergency fund.

Even so, there are drawbacks. Target-date funds don't account for your individual risk tolerance or the possibility that your circumstances may change. You might get a big promotion that enables you to retire five years earlier, for example. In that case, you'd want to review the allocations in your portfolio and decide if they still make sense for you.

Related retirement topics

Follow your own rules

Make (and follow) your own rules, too

No single approach to asset allocation addresses every scenario perfectly. Carefully consider your risk tolerance and when you plan to retire to establish an approach that works for you. You could also wing it -- but make sure that your seat belt is firmly buckled because it could be a wild ride.

FAQs

Asset allocation FAQs

What is the ideal asset allocation by age?

There's no perfect rule, but one that is often used by financial planners is known as the Rule of 110. To use it, simply subtract your age from 110 to determine the percentage of your portfolio that should be in stocks, with the remainder in fixed-income investments like bonds.

What is Warren Buffett's 90/10 rule?

The 90/10 rule is Warren Buffett's ideal asset allocation for the average investor. It involves allocating 90% of assets into a low-cost S&P 500 index fund, with the other 10% in bonds. However, this might not be an ideal mix for an older investor who doesn't have the risk tolerance to ride out the ups and downs of the stock market.

What is the 12/20/80 rule?

The 12/20/80 rule is an asset allocation rule that has three components. First, set aside 12 months of your monthly expenses in liquid assets, such as a savings account. Second, invest 20% of the remaining portfolio in fixed-income investments. Third, invest the other 80% in diversified equity (stock-based) investment funds.