Computers excel at crunching numbers but not at the things that many people do with ease, like language processing, visual perception, object manipulation, reasoning, planning, and learning. Artificial intelligence (AI), including its offshoots of deep learning and machine learning, uses computers to perform tasks that typically require human intelligence, such as language generation and facial recognition.

How do companies use AI?

How do companies use artificial intelligence?

Artificial intelligence, or AI, is created through machine learning, which involves training a system with a tremendous amount of data. It then uses the trained system to make inferences about new data it's never seen.

The simplest example is a system designed to detect objects in images. Images containing those objects are provided to the system, which "learns" how to detect them in other images. The more objects it detects in images, the more accurate the detection system becomes.

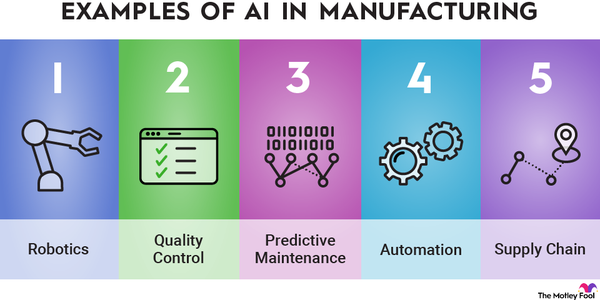

Companies employ AI in two main ways. Many tech companies use it to make their existing operations more powerful through high-profile applications like robotics, self-driving cars, and virtual assistants. AI is used by Alphabet subsidiary (GOOGL -1.85%) (GOOG -1.92%) Google to filter spam in Gmail, by Amazon (AMZN -2.58%) to recommend products to customers, and by Netflix (NFLX -1.4%) to guide content creation and recommendations.

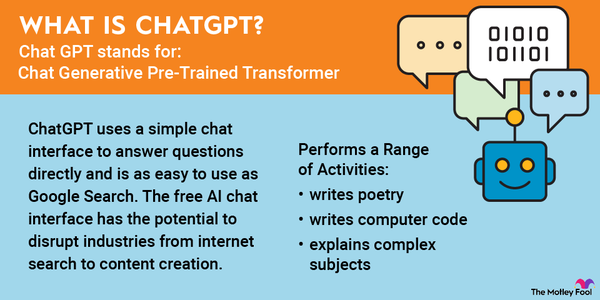

More recently, OpenAI's ChatGPT has shown how far generative AI -- a division of artificial intelligence capable of generating texts, images, sounds, and ideas -- has come. It can answer questions directly, write poems, and has even passed bar and medical exams, and has spawned a wave of new generative AI chatbots. The potential is enormous.

Generative AI

Some companies also profit directly from AI by selling hardware, software, services, or expertise that the technology requires. These are true AI stocks and include those listed and described below.

Five AI stocks to buy in 2025

Five AI stocks to buy in 2025

| Company | AI Focus |

|---|---|

| Nvidia (NASDAQ:NVDA) | Data center GPUs and superchips. |

| Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) | Generative AI and self-driving cars. |

| Microsoft (NASDAQ:MSFT) | Memory chips for data centers and generative AI tools. |

| CoreWeave (NASDAQ:CRWV) | Generative-AI focused cloud infrastructure platform |

| Arm Holdings (NASDAQ:ARM) | Developing power-efficient CPU technology for AI. |

1. Nvidia

Leading graphics processing unit (GPU) company Nvidia has taken advantage of the AI boom, with its GPUs becoming the de facto standard in data centers worldwide. Generative AI's training phase demands a lot of computing power; the phase that follows, the inference phase, typically requires less. Graphics processing unit (GPU) chips, which were once used primarily for rendering video games, support both phases well.

Nvidia's data center business now makes up the vast majority of the company's revenue, thanks to the emergence of generative AI. Because it sells the building blocks for AI infrastructure, Nvidia became the first major company to see a significant revenue boost from AI. Revenue surged through 2023 and 2024, and the stock has soared as well; in November 2024, it was briefly the most valuable company in the world. Full-year revenue in 2024 jumped 114% to $130.5 billion, driven by the surge in data center demand.

Its chips are popular for running demanding workloads that applications like large language models require. The pure-play chip stock is now selling its new Blackwell platform, which major cloud infrastructure services are deploying in 2025, and demand is outstripping supply.

Self-driving cars and "embodied AI" are another area of focus. Nvidia develops hardware and software platforms that can power driver-assistance features and fully autonomous driving, which could be a significant source of revenue if that industry takes off.

A self-driving car must process massive amounts of data from multiple sensors and cameras in real time, detect objects such as pedestrians and other vehicles, and make complex decisions. They require tremendous computing power, which is exactly what Nvidia's platform delivers.

Its professional visualization segment, which includes its omniverse, also has a lot of potential in AI. Nvidia's GPUs could someday be supplanted by more specialized processors designed for AI, but the company is in an enviable position for now.

2. Alphabet

Alphabet has been preparing for the AI revolution for years, acquiring the AI research lab DeepMind in 2014. It's also among the leaders in autonomous vehicles through its Waymo subsidiary, which is now ferrying passengers in its driverless cars in cities like San Francisco and Phoenix.

Alphabet launched Gemini, its own AI chatbot, the latest chatbot iteration in its competition with ChatGPT, which has been seen as a threat to Google Search. So far, concerns about a challenge to its search dominance seem to have been overblown as Alphabet's ad revenue continues to grow steadily.

With information at the heart of its business, it's unsurprising that the company has prioritized AI. It's rolled out AI tools for Google Cloud and Google Workspace, including a generative AI assistant that helps write emails. Even its customer acquisition strategy in the cloud is based around AI -- the company has targeted AI start-ups for its cloud infrastructure service.

AI also plays a role in improving its search engine and in YouTube, where it can pinpoint a relevant section of a video and direct users straight to it.

It's also ramping up spending on capital expenditures with plans to spend $75 billion on AI infrastructure and related needs in 2025.

3. Microsoft

Microsoft has gotten a lot of buzz lately, thanks to its partnership with OpenAI. The tech giant began investing in the tech start-up in 2019 and invested another $10 billion in OpenAI following the launch of ChatGPT.

Microsoft has incorporated GPT features across its product portfolio, including its Azure cloud infrastructure service, Edge web browser, Office productivity software suite, and Copilot for Microsoft 365. Azure OpenAI has seen a particularly strong uptake, now counting more than 65% of the Fortune 500 as customers.

CEO Satya Nadella has repeatedly said that he sees AI as the next major computing platform, and the reported $13 billion investment in OpenAI is a sign of the company's conviction in AI and its belief that it needs to lead that transition or get left behind as it did with mobile.

More recently, Microsoft has begun diversifying away from OpenAI, adding both internal and third-party models to products like Microsoft 365 Copilot and Azure, including DeepSeek's R1. It's unclear what the long-term implications are for its relationship with OpenAI, but Microsoft seems to think it's wise to hedge its bets in the AI race.

Microsoft is also harnessing the power of AI in other ways, including automated clinical documentation in healthcare to reduce paperwork and administrative needs. It's also using Azure to allow customers to build custom AI tools.

4. CoreWeave

CoreWeave, which launched its initial public offering (IPO) in March 2025, may be the closest thing to a pure-play AI stock on the market, and it was the first major AI IPO.

Its cloud infrastructure platform was designed specifically for AI, and it counts customers like Nvidia, OpenAI, Meta Platforms, and Microsoft as part of its core customer base. In fact, Nvidia and OpenAI are both investors in the company.

CoreWeave has grown at an incredible pace over the last three years, generating almost nothing in revenue in 2022 to $1.9 billion in revenue in 2024. From 2022 to 2024, revenue grew by more than 100 times.

CoreWeave is risky since Microsoft accounted for 62% of its revenue; the business would suffer significantly if Microsoft pulled back on spending with the platform. There are signs that Microsoft pulled back on planned contract expansions with CoreWeave, which cast a larger pall over the AI sector.

CoreWeave's IPO was disappointing as it was undersubscribed, and it was forced to lower its IPO price due to lack of demand. However, the stock rebounded later during its first week of trading. The poor initial result also may have been a better reflection of the weakening investor sentiment than doubts about the business itself.

If you're looking for direct exposure to AI, CoreWeave may be a good option.

5. Arm Holdings

Arm Holdings went public in September 2023, and the chip designer has already established itself as a major player in AI. The company believes it is the only chip company that can be found everywhere, from the cloud to the edge.

Arm has a unique business model. It designs chip components and licenses those designs to partners like Nvidia, cloud infrastructure hyperscalers, and other chipmakers. After licensing those chips, it collects royalties on the revenue from selling products with its designs.

Arm also has an advantage in the AI race. Its chips are known for their power-efficient architecture, and AI applications like ChatGPT demand a lot of power. Using Arm's technology helps minimize its energy consumption, which is putting Arm's chips in high demand for AI. Along with Nvidia and Microsoft, Arm was also one of several partners named in the Stargate Project, which is expected to be the world's largest AI infrastructure project.

The chip designer doesn't have close competition for power-efficient CPU architecture, and it's leaning into that advantage, launching Arm Compute Subsystems (CSS), which are chip designs that the purchaser can take to market faster and target specific end users.

Because of the nature of Arm's competitive advantage in power efficiency over the X86 architecture favored by Intel (INTC -2.9%) and Advanced Micro Devices (AMD -7.42%), it's a good bet to benefit from the growth in AI; it's already seen a surge in license revenue from AI-related demand.

Machine learning stocks

Machine learning stocks

All the stocks above use machine learning technologies, but if you're looking for more options, here are two others worth considering:

- Palantir (PLTR -5.61%): Palantir has been one of the top-performing AI stocks. The company provides cloud software and specializes in data fusion that helps its customers make important insights by connecting disparate pieces of information hidden in data. It also launched its AI Platform (AIP) in 2023, which has helped accelerate its growth. Palantir deploys machine learning models on top of data foundations and continuously improves them to ensure that they become more useful.

- Tesla (TSLA -5.06%): Tesla might be best known for its electric vehicles, but CEO Elon Musk sees AI as the future of the company, and machine learning and neural networks are very much at the center of the company's autonomous vehicle and Optimus autonomous robot projects. Tesla introduced its driverless Cybercab in October 2024, and the company hopes to begin producing the vehicles by 2026. Musk has said that Tesla's automation technology could make it the most valuable company in the world.

Deep learning stocks

Deep learning stocks

Deep learning is a subset of machine learning that uses artificial neural networks inspired by the human brain. It's the most advanced kind of AI and is crucial in technologies like self-driving cars. Deep learning is advancing in areas such as preventive healthcare, where predictive algorithms are necessary. It differs from machine learning in that it doesn't require human input.

Nvidia is among the companies closely associated with deep learning. Its GPU chips use deep learning to power data centers and enable autonomous driving and cloud computing, among other functions.

Alphabet has exposure to deep learning through a number of its businesses, including its autonomous vehicle start-up, Waymo. It also owns DeepMind, a deep learning platform that can diagnose eye diseases, predict the shapes of proteins, and accelerate the scientific discovery process.

Related investing topics

AI is a growth business

According to International Data Corporation, the global artificial intelligence market is expected to grow from $235 billion in 2024 to more than $631 billion in 2028.

While the AI market is already large and still growing quickly, plenty of companies can profit from AI. Although picking stocks in a growth industry comes with a lot of uncertainty, these top AI stocks are all worth considering.

FAQ

Artificial intelligence stocks: FAQ

What is the best AI stock to buy?

Artificial intelligence is a fast-moving technology, and AI stocks will likely be volatile as the sector evolves. AI stocks that have attracted the most attention include Nvidia, Microsoft, and Alphabet, but finding the best stock to buy is also a matter of price and valuation, which changes quickly.

Is it good to buy Nvidia stock?

Nvidia has jumped into the lead among semiconductor companies in making AI chips and accelerators, and it has the competitive advantages to help it stay there. The semiconductor sector can also be highly cyclical, and pricing can change rapidly. Additionally, there's the potential for unexpected surprises like the DeepSeek launch, which sent AI stocks like Nvidia plunging. If Nvidia can maintain its lead in AI chips, the stock should continue to be a winner, but it will likely be volatile since the AI landscape is still developing.

What is the biggest AI company?

Currently, the biggest company that has made AI central to its business model is Nvidia, with a market cap that has soared past $3 trillion at one point. The tech giant is at the center of the AI revolution as its components are fueling AI applications and are in high demand by major cloud infrastructure companies and others.

Is AI good for investing?

Artificial intelligence is likely to shake up the economy and the business world, creating opportunities in the stock market. Whether AI is good for investing will depend on the company, but there will be winners from the new technology.

What company is No. 1 in AI?

Currently, Nvidia is broadly considered the leader in AI technology. The company has a monopoly-like market share in the data center GPU market and its revenue has more than tripled since ChatGPT launched. Nvidia isn't guaranteed to remain the leader, though. Competition is on the way, and new technologies can change quickly.