A cost-of-living adjustment, or COLA, is an inflation-based increase rolled out annually to all recipients of Social Security and Supplemental Security Income (SSI). For 2025, the Social Security COLA is 2.5%. We'll explain below exactly what that means for recipients.

What is it?

What is the Social Security COLA?

The Social Security COLA, or cost-of-living adjustment, is an annual adjustment to Social Security checks aimed at preserving the purchasing power of benefits. Without Social Security COLAs, benefits would buy less over time due to the effects of inflation.

Each October, COLAs for the following year are announced based on changes to the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). Beneficiaries then receive the increase in January.

The 2025 COLA

What is the Social Security COLA for 2025?

As mentioned, the Social Security COLA for 2025 is 2.5%. The Social Security Administration (SSA) announced the official 2025 COLA on Oct. 10, 2024, following the release of September 2024 inflation data.

The 2025 COLA will bump the average retired worker's monthly payment from $1,927 to $1,976, a $49 increase. The COLA takes effect in December, and the updated benefits are paid out starting in January 2025.

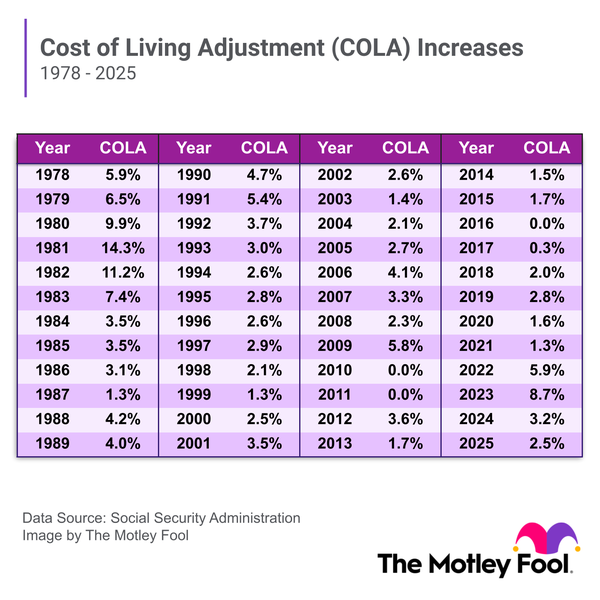

The 2025 Social Security raise is lower than the 3.2% beneficiaries received in 2024 or the 8.7% COLA for 2023. The 2023 increase was the highest since 1981 and the fourth-largest COLA in the program's history.

From 2010 to 2019, COLAs were 2% or less in eight out of 10 years. However, soaring inflation triggered by the COVID-19 pandemic resulted in the highest COLA in more than 40 years in 2023. The smaller COLAs in 2024 and 2025 reflect cooling inflation. Inflation in July, August, and September 2024 determined the COLA that Social Security and SSI beneficiaries will receive in 2025.

The calculation

How is the Social Security COLA calculated?

As mentioned, the COLA computation relies on changes in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). Like other measures for inflation, the CPI-W is calculated monthly by the Bureau of Labor Statistics.

Each year, the SSA averages the CPI-W value for the third-quarter months of July, August, and September. The average is then compared to the same value for the prior year. If the current year's average is higher, the percentage increase is the COLA.

For example, the third-quarter CPI-W for 2024 was 308.729. In the previous year, the average was 301.236. The percentage difference here is 2.5%, which became the 2025 COLA. Social Security and SSI recipients will see their benefits increase by that percentage in January 2025.

Related retirement topics

Start collecting

When can I start collecting Social Security?

You can start collecting Social Security retirement benefits at age 62. However, you won't be eligible for your full benefit until you hit full retirement age (FRA), which is 67 for anyone born in 1960 or later. If you claim benefits early, you'll permanently reduce the amount you can collect each month, though the trade-off is you'll get more checks during your lifetime.

You can also increase your benefits by waiting to collect Social Security past your full retirement age. You can receive an extra 8% for each year you delay past your FRA until your benefit maxes out at age 70.

FAQ

Social Security COLA FAQ

How is the COLA determined?

The COLA is determined by increases in the Consumer Price Index for Urban Wage Earners and Clerical Workers for July, August, and September, compared to the same three months for the previous year. If the CPI-W for these three months in the current year has increased over the previous years, the percentage increase is the COLA.

Will Medicare premiums increase in 2025?

The 2025 Social Security COLA is the smallest increase since 2021, but there's another unwelcome development for millions of seniors: Medicare participants will pay higher premiums next year.

Premiums for Medicare Part B, which covers doctor visits and other outpatient care, will rise from $174.80 to $185 in 2025, a 5.8% increase. That means Social Security beneficiaries won't see their full COLA reflected in their monthly benefit since most recipients have Part B premiums deducted from their benefits.

By law, Medicare Part B premiums cannot increase by more than the COLA in the same year.

What is the Social Security COLA for 2025?

The Social Security COLA for 2025 is 2.5%.

What is the Social Security program?

The Social Security program is a federal program that provides benefits to workers when they retire or become disabled. The program also provides benefits to surviving relatives of deceased workers. It's funded primarily by payroll taxes paid by workers and their employers.

Do all Social Security recipients receive a COLA?

Yes, all Social Security beneficiaries receive a COLA, whether they're receiving retirement, disability, or survivor benefits. COLAs also apply to Supplemental Security Income (SSI), a needs-based program that the Social Security Administration oversees.

The Motley Fool has a disclosure policy.