Cryptocurrency receives quite a bit of criticism for its large carbon footprint. The biggest offender is market leader Bitcoin (CRYPTO:BTC), which consumes as much energy as a medium-sized country.

However, not every cryptocurrency is an energy guzzler. Although many digital currencies (especially earlier ones) require substantial computing power, there are also plenty of greener alternatives. One reason is a gradual transition from the original proof-of-work model to the more efficient proof-of-stake model to validate transactions.

If you're interested in investing in eco-friendly cryptocurrencies, here are the top options:

1. Ethereum

1. Ethereum

Ethereum (ETH 0.72%) is the second-largest cryptocurrency. During its early years, it wasn't making any eco-friendly crypto lists. Like Bitcoin, it used a proof-of-work system and consumed a massive amount of energy through its mining process.

That all changed on Sept. 15, 2022, when Ethereum switched to a proof-of-stake system in an upgrade known as "The Merge." Thanks to this change, the Ethereum network reduced its energy usage by over 99.9%, according to the Cambridge Centre for Alternative Finance.

Ethereum is notable for introducing smart contracts, which are programs written on the blockchain. There are all kinds of ways to use smart contracts, including developing decentralized finance (DeFi) applications, minting non-fungible tokens (NFTs), and launching stablecoins. While Ethereum is now far from the only blockchain network to have smart contracts, its first-mover advantage has kept it in front of the competition.

2. Algorand

2. Algorand

You won't find many cryptocurrencies that have made a bigger commitment to going green than Algorand (ALGO 1.97%). On Earth Day 2022, it blacked out almost 20 billboards in Times Square and announced that it's a carbon-negative blockchain.

Algorand is a blockchain platform that can run smart contracts, making it one of many competitors to Ethereum. Its carbon footprint was already small because it uses the proof-of-stake model to validate transactions.

To become carbon-negative, Algorand launched a smart contract that will offset the carbon footprint of every transaction without any action needed on the user's part. It will also use a portion of its network fees to buy carbon credits through ClimateTrade.

3. Solana

3. Solana

Solana (SOL 5.6%) is a proof-of-stake blockchain with smart contract functionality. It first achieved carbon neutrality in 2021, but what got more people's attention that year was its returns of more than 11,000%.

This cryptocurrency is most famous for its speed and efficiency. It regularly processes more than 4,000 transactions per second, and it's reportedly capable of handling over 65,000. Transaction fees are also some of the cheapest of any cryptocurrency, generally ranging from about $0.0024 to $0.048, according to data from Solscan.

Along with its proof-of-stake model, Solana adds its own innovation, called proof of history. This records the order of transactions and the amount of time between them. The hybrid protocol is how Solana achieves such impressive processing speeds.

4. Cardano

4. Cardano

Cardano (ADA 1.42%) is one of the most well-known "green cryptocurrencies." It used to be the biggest proof-of-stake cryptocurrency by market cap, and it has always prioritized sustainability.

Cardano aims to provide a programmable ecosystem that can address real-world problems. For example, it partnered with the Ethiopian government so schools could store their students records on the Cardano blockchain. Another example is supply chain tracking: Georgian winemakers have used the Cardano blockchain so their customers can verify the authenticity of the wine they buy.

It uses about the same amount of energy per year as 600 U.S. homes, and, due to its proof-of-stake model, Cardano is highly scalable. Although the project has been around since 2015, it progresses at a more measured pace. It follows a scientific approach based on peer-reviewed research.

5. XRP

5. XRP

XRP (XRP 0.78%) is the native cryptocurrency for Ripple, a global payments platform. It's designed to make international money transfers easier, faster, and more affordable, and it has largely succeeded at that. Transactions cost just 0.00001 XRP, which is a fraction of a cent, and process in three to five seconds.

Ripple's consensus mechanism uses trusted validators to agree on transactions and update its blockchain. This system uses little energy, which is offset through carbon credits that Ripple purchases.

The biggest issue with Ripple to date has been an SEC lawsuit filed in 2020. Many top cryptocurrency exchanges didn't even list XRP because of those legal issues. But after a favorable ruling, XRP is available on quite a few U.S. exchanges again.

Are these coins secure?

Are these coins secure?

Both proof-of-work and proof-of-stake models are considered secure by experts. They simply achieve security in different ways.

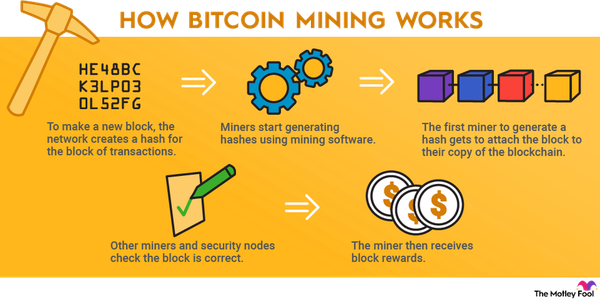

The proof-of-work model chooses validators based on which mining devices solve complex mathematical problems. Winning this competition requires a significant amount of processing power and energy consumption. If a miner included incorrect transactions in a block it validated, the rest of the network would ignore them, and they would have used all that energy for nothing.

The proof-of-stake model chooses validators based on the number of coins staked. If you have a higher stake, you're more likely to be selected. On large blockchains, like those of Ethereum, Algorand, Solana, and Cardano, no single validator will have a large enough stake to trick the system.

Related investing topics

Buying eco-friendly crypto

Buying eco-friendly cryptocurrencies

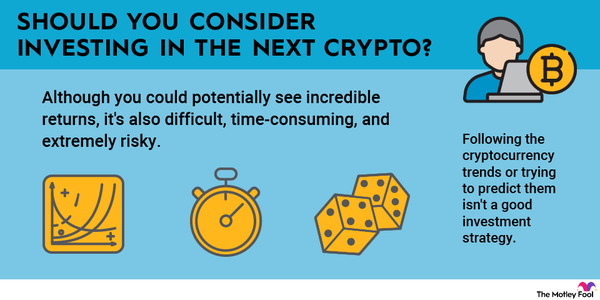

While sustainability is certainly important, keep in mind that a low-carbon footprint on its own isn't the only thing to look at when investing in cryptocurrency. For proof of that, just look at Chia (XCH -0.96%), an eco-friendly crypto that lost a whopping 97% of its value in less than a year.

There are thousands of eco-friendly cryptocurrencies on the market. Almost any cryptocurrency that doesn't use the proof-of-work model will consume a fraction of the energy.

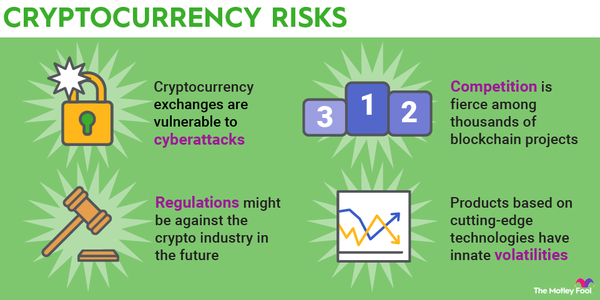

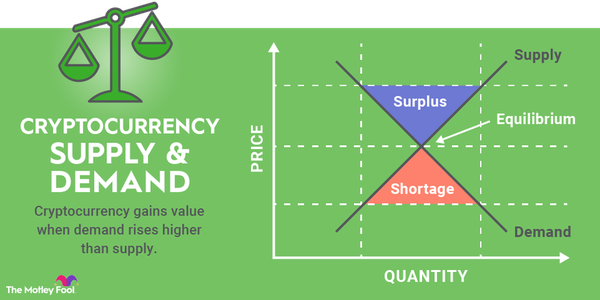

Energy usage is one factor to look at in cryptocurrency projects. You should also look at a project's goals, what makes it unique, the problems it aims to solve, and the team behind it. And, since cryptocurrency is a notoriously volatile market, be cautious about how much you invest, and be prepared for prices to fluctuate.