An estimated 93 million Americans owned at least a small fraction of a Bitcoin (CRYPTO:BTC) in the fall of 2024. An average of about 300,000 Bitcoin tokens change hands every day. At the same time, many prospective crypto buyers have not pulled the trigger on buying their first Bitcoin slice because they don't understand digital currencies.

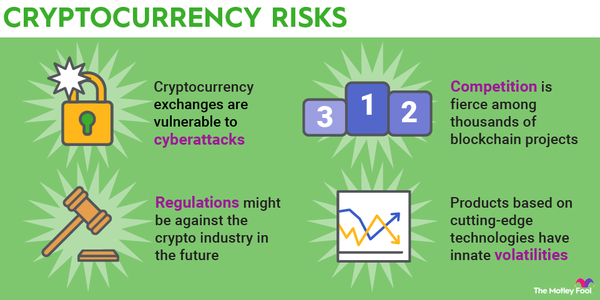

The risks of trading cryptocurrencies are considerable, so you need to think them over before taking the plunge. So, let's take a look at the dangers and challenges investors face in the cryptocurrency market.

What is it?

What is cryptocurrency?

A cryptocurrency is a digital asset connected to a blockchain network, which keeps track of holdings and transactions behind several layers of cybersecurity. Some cryptocurrencies are designed to act as digital currencies and long-term stores of value.

Some projects have tailored their technical features to support fast transaction settlement, often at the expense of looser data security. Others offer additional features, such as smart contracts and decentralized computing platforms, which facilitate advanced products, like non-fungible tokens (NFTs) and decentralized finance apps.

Bitcoin is the leading name in the value-store category. Most users and developers rely on Ethereum (CRYPTO:ETH) for smart contracts. Bitcoin and Ethereum are the most substantial cryptocurrency networks today. Thousands of smaller and newer cryptocurrencies exist, and even the largest names in this ever-expanding group are known as altcoins.

Risks

Understanding the risks of trading cryptocurrencies

Cryptocurrencies can be exciting. This sector is always on the move, and it is not unusual to see the latest market darling skyrocketing to fantastic short-term gains.

However, cryptocurrencies are also fraught with risk. At a bare minimum, you should consider the following risks and threats of cryptocurrencies before you invest in this thrilling but dangerous sector.

1. Volatility

Soaring crypto prices can nosedive the very next day. Volatility is not the place to be if you are uncomfortable with market risks. Prices will rise and fall, just like in the stock market, but the swings tend to be sharper among digital assets.

2. Unclear valuation

Investors in the stock market have the benefit of business operations with concrete financial results. Stock prices can be based on the underlying company's sales, earnings, growth rates, cash flows, dividend yields, and many other factors.

That's not the case in the crypto market. Some digital coins have real-world uses as the basis for next-generation financial services, but even then, the long-term prospects are hazy. In many cases, crypto investors lack a financial framework suitable for a proper market-value analysis.

Crypto critics like to compare these assets to the tulip bulb mania or the dot-com bubble -- it can be hard to find any sustainable value in a heap of computer-generated data.

3. Hacking risks

To mess up the transaction ledger of a blockchain, a hacker generally must control more than half of the network's validation nodes. Once a cryptocurrency grows large enough to pop up on your investing radar, it's probably safe from these brute-force hacks.

However, the cryptocurrency exchange where you make your crypto trades and store your digital holdings may be targeted by other cybersecurity threats. That's usually the story when you see headlines about "crypto hacks."

It's important to use crypto-trading services with hacker-proof security. Larger names, such as Coinbase (CRYPTO:COIN), Binance, and Kraken, are always under attack but rarely breached. So, that's a good place to start. You should also enable the toughest login security your chosen service offers.

4. Lacking regulations

Governments and regulatory bodies around the world are still figuring out how to manage cryptocurrencies. Some, such as El Salvador and the Central African Republic, went all-in by adopting Bitcoin as an official currency -- but their Bitcoin commitment didn't last long.

On the other hand, officials in India and China have declared cryptocurrencies illegal. Most markets fall somewhere between the extremes, and the U.S. government is still grappling with the issue of cryptocurrency regulation. A couple of high-profile court cases may bring some clarity to the legal framework, but they are part of a larger process, and these things take time.

Should digital coins be treated as a dollar-like currency or more like a financial asset? The classic Howey Test can settle that question, but regulators and courts have not yet settled on a clear answer that applies to every cryptocurrency.

This classification will inform the rules for holding, trading, creating, and charging taxes on cryptocurrencies, and there are no easy choices here. A one-size-fits-all solution could be a mistake since different cryptocurrencies have different goals and features, and they might need a variety of regulatory treatments on a case-by-case basis.

Until the murky regulatory waters clear up, many investors will continue to shy away from this messy situation. That's particularly true for institutional investors and other well-heeled sources of capital.

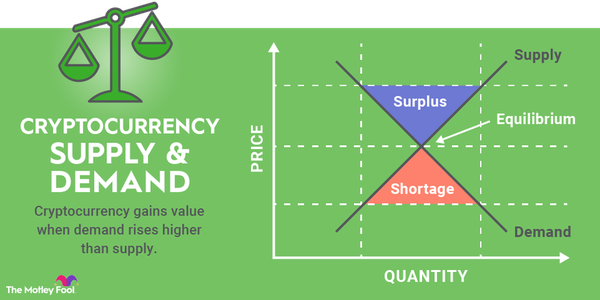

5. Decentralization

Many investors and crypto enthusiasts see decentralization as an important feature of digital assets. Cutting intermediaries, such as banks and financial service providers, from the equation reduces transaction fees and speeds up processing times. Data validation across a global network adds to the security of blockchain systems.

But decentralization can be a double-edged sword. Truly decentralized blockchain networks are managed by consensus and votes among a global community, which raises a number of potential problems.

Proposed changes to a particular blockchain technology may not be popular, delaying or even blocking helpful or outright necessary tweaks. Groups with malicious intent could infiltrate communities and take control over time. The voting systems themselves might be imperfect, allowing a different kind of hacker attack that targets the blockchain's steering community.

6. Lost crypto wallet keys

Cryptocurrency holdings are held in a digital wallet. You can use the wallet services of your preferred trading platform, set up a digital wallet on your smartphone, and even purchase a special gadget that does nothing but store cryptocurrency keys.

What happens if you forget the password to your digital wallet? Even worse, what if you lose the smartphone or hardware wallet that holds your Bitcoin and Ethereum assets?

Getting your digital money back can be difficult or even impossible. Computers won't go out of their way to help you recover a lost fortune; a human banker might.

Should I invest?

Who should invest in cryptocurrencies?

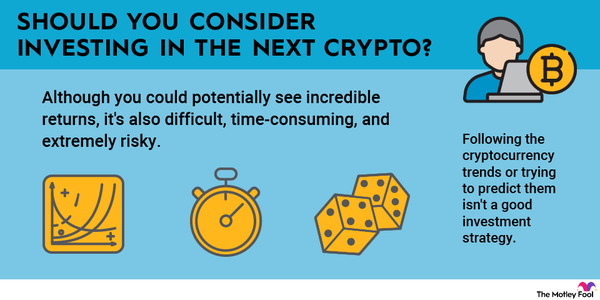

Cryptocurrencies could be a great investment -- for some people. However, you must accept every risk listed above, be prepared to find additional spots of trouble over time, and generally be ready to stay informed.

The more you know about how blockchain networks and digital currencies actually work, the more likely you are to find long-term winners in this chaotic sector. There's work to be done both before you get started and along the way.

In the end, cryptocurrencies are not every investor's cup of tea. Any of the risks above could be deal breakers for you -- and that is perfectly fine.

You don't need to stress out over risk-laden cryptocurrencies. There are many other ways to get used to the ins and outs of building wealth for the long term.

For example, the stock market gives you lots of options. Many companies have direct ties to the crypto sector, which lets you benefit from the digital assets through the lens of a fully regulated trading system. That's one way to dip your toes in the crypto market without actually buying any cryptocurrencies.

Related investing topics

Long term

Holding cryptocurrency for the long term

If you still want to put some money directly into the cryptocurrency market after all these warnings, that's also fine. Here at The Motley Fool, we recommend you take a long-term view of whatever market you have chosen to invest in because that's the best way to increase wealth in the long run.

Keep an eye on the news to stay up to speed. Just don't overreact to the daily headlines. You don't need to "hodl" your cryptocurrencies forever, but the wild short-term swings tend to cancel each other out over time. As long as you pick names with solid long-term prospects, the temporary chart squiggles won't matter. It's all about pocketing compound returns over many years, just like in the stock market.

FAQ

Risks of trading crypto: FAQ

What are the negative effects of cryptocurrency?

Cryptocurrencies have many potential downsides, whether the digital coins become popular or not. Some cryptocurrencies use an exorbitant amount of electric power, driving environmentally conscious people away from the sector. Many investors worry that the crypto boom won't last, ending with a game-changing hack or a broad rejection by users and investors everywhere.

Master investor Warren Buffett has called Bitcoin "worthless" and wouldn't buy digital assets at any price. And if cryptocurrencies eventually take over the payment and wealth management roles played by dollars and gold today, that revolution could throw the world economy into chaos overnight.

Is crypto riskier than stocks?

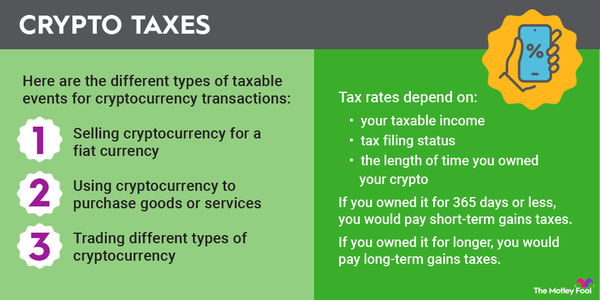

Stocks are bought, sold, and owned under a strict framework of regulatory restrictions, tax laws, and information disclosure requirements. These investor protections are rarely seen in the crypto world, though that might change over time. Moreover, investors are still figuring out how to handle this newfangled asset class and its many risks.

In 2025, the answer is a clear "yes."

Is crypto safer than banks?

Some crypto enthusiasts would say so, given the decentralized nature of blockchain networks and the community-driven governance of crypto projects. Unlike the dollars and euros seen in traditional economics, no government holds absolute power over these digital currencies.

However, the many risks listed above suggest that nothing has changed yet. Decentralized transaction ledgers may dodge a couple of threats, but there are many other issues to consider. And I didn't even bring up the crypto market's extreme volatility yet.

Cryptocurrencies are not safer than banks. They might reach that pinnacle someday, but it's a distant goal.