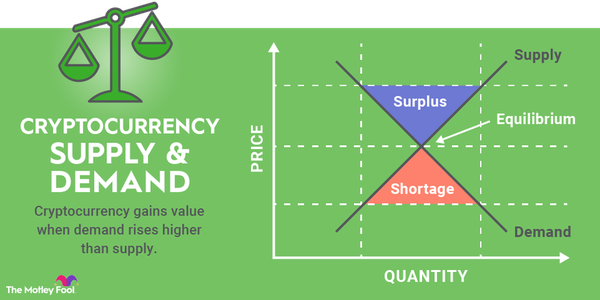

Everyone who invests in cryptocurrency wants to find coins that will increase in price. To figure that out, it's important to understand how cryptocurrency prices are determined. You might already know the factors that affect the stock market. Although there are many similarities, the crypto market is its own entity and doesn't follow all the same rules.

Overview

What determines cryptocurrency prices?

The factors that have the most influence on cryptocurrency prices are:

- Supply.

- Demand.

- Utility.

- Competition.

- Availability.

- Popularity.

Let's take a closer look at each of these factors and some examples of how each has affected crypto prices.

Supply

Supply

Supply refers to both the maximum number of coins or tokens that a cryptocurrency offers and the amount currently available for purchase. Maximum supplies vary considerably depending on the cryptocurrency; some have maximum supplies in the millions, and others have trillions or even quadrillions of tokens.

A cryptocurrency with a smaller supply is scarcer and will generally carry a higher price as a result. The most prominent example is Bitcoin (BTC 0.39%), which has a fixed maximum supply of 21 million. Bitcoin has typically been the cryptocurrency with the highest price because there will only be 21 million available, with no way of minting more.

Some cryptocurrencies use a strategy called "burning" to reduce their supplies. Tokens are sent to an inaccessible crypto wallet to be removed from circulation. Although this is marketed as a way to increase a cryptocurrency's price, a smaller supply doesn't automatically lead to a higher price. The next factor also needs to be present for this to work.

Demand

Demand

Demand refers to the market's interest in buying a cryptocurrency. If there are more new investors willing to buy a cryptocurrency at its current price than there are sellers, the price will increase.

There are many reasons demand can rise for a cryptocurrency. In 2021, Bitcoin started receiving increased scrutiny because of its environmental impact. Investors began searching for "green cryptocurrencies" that don't require as much energy. That led to more demand for Cardano (ADA 1.42%), a cryptocurrency with a much smaller environmental footprint.

Solana (CRYPTO:SOL) has been in high demand multiple times, including in 2021 and 2024, for its speed and low transaction costs. Some cryptocurrencies have transactions that take minutes and cost $0.50 or more. On the Solana blockchain, transactions settle in seconds and cost a fraction of $0.01, making it a popular choice for launching crypto projects.

Utility

Utility

Utility is how the cryptocurrency and/or its platform can be used. Many successful cryptocurrency projects have one or more real-world problems that they're aiming to solve.

Bitcoin was designed to be a digital currency that didn't rely on a central authority such as a bank or a government to manage it. Ethereum (CRYPTO:ETH) introduced the concept of a smart contract blockchain -- a blockchain that can run self-executing programs. Developers can use smart contracts to launch decentralized apps (dApps) on these blockchains.

Those are a few of the most popular examples, but there are many more. Others include XRP (CRYPTO:XRP), which is designed to facilitate cross-border transactions, and Monero (XMR -1.51%), a privacy coin reportedly offering untraceable transactions.

Competition

Competition

Competition refers to other cryptocurrencies and, more specifically, the cryptocurrencies that occupy a similar role in the market. Bitcoin and Ethereum are competitors in the sense that they're both types of cryptocurrency, but they're not direct competitors. Bitcoin is now seen primarily as a digital store of value, and Ethereum is a smart contract blockchain.

Ethereum's direct competitors are other blockchains with smart contract functionality, including Cardano and Solana. Since these projects all have similar purposes, many users will gravitate toward just one. If most developers start using Solana, it will negatively affect Ethereum and Cardano.

Availability

Availability

Availability refers to how easy it is to buy a cryptocurrency. The more widely available a cryptocurrency is, the more likely that people will invest in it. While some enthusiasts are willing to go on unregulated exchanges to obtain cryptocurrencies that catch their eye, most investors stick to the top crypto exchanges such as Coinbase Global (COIN -2.1%).

Cryptocurrencies often see their prices increase when they get listed on a major exchange. There are even terms for this -- the "Coinbase effect" and the "Binance effect" -- meaning the bump that cryptocurrencies get from being on those popular crypto exchanges. An analysis by Ren & Heinrich found that crypto prices increased by 41% a day after being listed on Binance and by 73% after the first 30 days.

XRP (CRYPTO:XRP), one of the largest cryptocurrencies in the world, is another example of the power of exchange listings. Many top exchanges delisted it when its parent company, Ripple, became embroiled in a Securities and Exchange Commission (SEC) lawsuit in 2020, alleging that XRP was an unregistered security. When a judge ruled that XRP wasn't a security in 2023, Coinbase and other exchanges relisted XRP, and its price immediately rose by over 80%.

Related investing topics

Popularity

Popularity

Although it would seem that utility and technology should be most important for cryptocurrency investments, that's not always the case. Popularity matters quite a bit. Look no further than Dogecoin (CRYPTO:DOGE) and Shiba Inu (CRYPTO:SHIB), two meme coins that rank among the largest cryptocurrencies in the world.

Popularity alone usually doesn't lead to long-term success, however. Cryptocurrencies that rely on popularity over functionality generally fall off quickly once the hype ends. Eventually, they run out of people willing to buy because they don't offer any actual uses.

A lack of popularity can also be an issue, even if a cryptocurrency checks all the boxes. Neo (NEO -1.73%) is one example of a cryptocurrency that does well from a technology perspective but has disappointed investors due to poor marketing.

There are quite a few other factors that can affect cryptocurrency prices, but the ones we've gone over here have the biggest impact. If you're evaluating a cryptocurrency as an investment, it's a good idea to consider how it does in each of these areas.