If you're looking to gain exposure to Bitcoin (BTC 0.43%) but prefer the convenience of trading like you would with a stock, then a Bitcoin exchange-traded fund (ETF), like the Grayscale Bitcoin Trust ETF (GBTC 0.42%) might be the solution you need.

Investing in this exchange-traded fund (ETF) offers a more accessible way to gain exposure to Bitcoin without the complexities of direct cryptocurrency transactions. Here's everything you need to know about Grayscale Bitcoin Trust ETF and how to get started investing in it.

Exchange-Traded Fund (ETF)

What is Grayscale Bitcoin Trust ETF?

What is Grayscale Bitcoin Trust ETF (GBTC)?

The Grayscale Bitcoin Trust ETF is an investment fund that provides investors with exposure to Bitcoin by tracking the CoinDesk Bitcoin Price Index.

When you buy shares of this ETF, you are effectively purchasing exposure to the real-time (spot) price of Bitcoin since the fund directly holds Bitcoin as its underlying asset.

This ETF trades much like any stock traded on an exchange, as opposed to mutual funds that trade only once per day at market close.

It has a bid price, which is the highest price a buyer is willing to pay for a share, and an ask price, which is the lowest price at which a seller is willing to sell a share.

This makes it easy to buy and sell shares of the fund during market trading hours, similar to how you would trade shares of any publicly listed company.

This Grayscale ETF is not only a convenient way to invest in Bitcoin but also a very large and popular ETF in its niche.

As of March 2025, it averaged about 1.4 million shares traded daily and reported more than $16 billion in assets under management (AUM).

How to buy

How to buy Grayscale Bitcoin Trust ETF (GBTC)

- Open your brokerage app: Log into your brokerage account where you handle your investments.

- Search for the stock: Enter the ticker or company name into the search bar to bring up the stock's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.

Expense Ratio

Holdings

Holdings of Grayscale Bitcoin Trust ETF (GBTC)

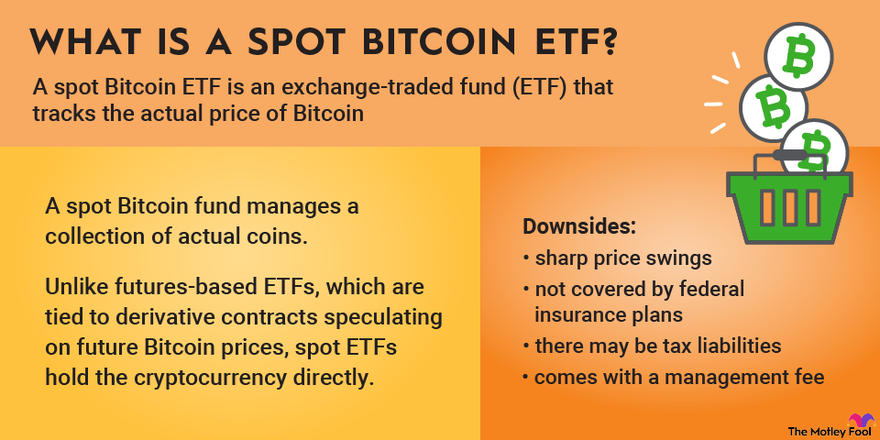

The Grayscale Bitcoin Trust ETF is classified as a spot Bitcoin ETF, meaning its primary holdings are actual Bitcoin rather than just futures based on Bitcoin's price.

The Bitcoins are securely stored with Coinbase Custody Trust Company, which acts as the custodian for the assets.

As of March 2025, the Grayscale Bitcoin Trust ETF's total holdings amounted to 194,186.5228 Bitcoins. This substantial cache of Bitcoin translates to approximately 0.00079089 Bitcoins per individual share of the ETF.

Investors who buy shares of Grayscale Bitcoin ETF are essentially buying a proportional slice of this pooled Bitcoin.

Should I invest?

Should I invest in Grayscale Bitcoin Trust ETF (GBTC)?

Deciding whether to invest in this ETF is a personal decision that hinges on your financial goals and tolerance for risk.

If your primary objective is to gain exposure to Bitcoin through a traditional brokerage account, trading this Grayscale ETF can be an excellent choice.

It offers the convenience of trading just like any other stock, bypassing the complexities and technical challenges associated with buying Bitcoin directly through a cryptocurrency exchange and managing your own digital wallets. The convenience factor makes this Bitcoin ETF particularly appealing to investors familiar with the stock market but new to cryptocurrencies.

Additionally, if you are comfortable with long-term ETF investments and are looking for aggressive but risky growth potential, the Grayscale Bitcoin Trust ETF could be a suitable option.

Although it is true that the ETF is highly volatile and can experience significant price fluctuations (like Bitcoin), it has also seen periods of substantial returns.

Dividends

Does Grayscale Bitcoin Trust ETF (GBTC) pay a dividend?

The Grayscale Bitcoin Trust ETF does not pay a dividend because its underlying asset, Bitcoin, does not generate yield.

Bitcoin is a digital currency and does not offer dividends or interest payments like traditional income-generating investments, such as stocks or bonds.

This ETF might not be the right choice for investors whose primary goal is to generate income from their investments. A dividend ETF or a Bitcoin covered call ETF may be more suitable.

Expense ratio

What is Grayscale Bitcoin Trust ETF's expense ratio?

This Bitcoin ETF charges a 1.5% expense ratio. This expense ratio represents the annualized percentage deducted from your total investment to cover the ETF's operational fees and expenses.

For instance, if you invested $10,000 in this ETF, you could expect to pay about $150 per year in fees.

You don't pay this fee directly out-of-pocket; instead, it is deducted from the returns of the ETF on an ongoing basis.

It's important to note that higher expense ratios can be undesirable because they compound and can significantly eat into your total returns.

The Grayscale Bitcoin Trust ETF expense ratio is on the higher side. This is somewhat typical for funds that offer specialized exposure to investments, such as cryptocurrencies.

Historical record

Historical performance of Grayscale Bitcoin Trust ETF (GBTC)

Here's a look at this ETF's historical returns based on net asset value (NAV) over various periods as of early 2025:

| Metric | 3 months | 6 months | YTD | 1 year |

|---|---|---|---|---|

| NAV per share (%) | -13.98 | 42.17 | -10.19 | 33.47 |

| Benchmark index (%) | -13.66 | 43.23 | -9.96 | 35.50 |

Related investing topics

The bottom line

The bottom line on Grayscale Bitcoin Trust ETF (GBTC)

This Grayscale ETF provides a straightforward, traditional way for investors to gain exposure to Bitcoin without the complexity of direct cryptocurrency management.

It mimics the price movements of Bitcoin by directly holding the digital asset, making it a suitable option for those looking to incorporate cryptocurrency into their investment portfolio via a familiar stock exchange platform.

Keep in mind, however, that the Grayscale Bitcoin Trust ETF charges a fairly high expense ratio, and the potential for high returns comes with greater risk. Treat it as a high-volatility sector ETF.

FAQs

Investing in Grayscale Bitcoin Trust ETF FAQs

Is Grayscale Bitcoin Trust an ETF?

As of Jan. 11, 2024, Grayscale Bitcoin Trust ETF became an ETF. Before then, it was technically a closed-end fund (CEF).

How to buy Grayscale Bitcoin ETF?

You can buy shares of Grayscale Bitcoin Trust ETF through most brokerage accounts by placing an order, just as you would with any other stock or ETF.

Can anyone buy Grayscale Bitcoin Trust?

Grayscale Bitcoin Trust ETF is available to most U.S. retail investors, although accessibility may vary depending on the specific policies and restrictions of your brokerage firm.