Dividend investing can be a great investment strategy. Dividend stocks have historically outperformed the S&P 500 with less volatility. That's because dividend stocks provide two sources of return: regular income from dividend payments and capital appreciation of the stock price. This total return can add up over time.

Dividends Per Share

Because of their lower volatility, dividend stocks often appeal to investors looking for lower-risk investments, especially those in or nearing retirement. But dividend stocks can still be risky if you don't know what to avoid. Here's a closer look at how to invest in dividend stocks.

How they work

How dividend stocks work

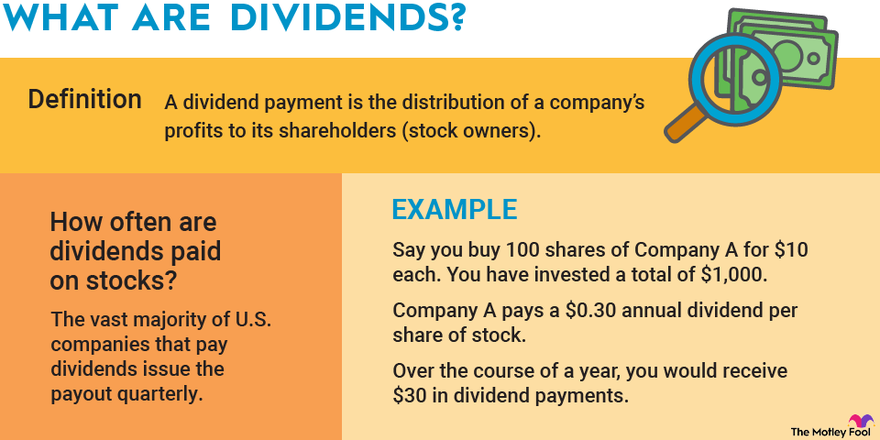

Let's look at an example. Say you buy 100 shares of a company for $10 each, and each share pays a dividend of $0.50 annually. If you invested $1,000, you would receive $50 in dividend payments over the course of a year. That works out to a 5% dividend yield -- not too shabby. What you choose to do with your dividends is up to you. You can:

- Automatically reinvest them to buy more shares of the company through a dividend reinvestment plan (DRIP).

- Buy stock in a different company.

- Save the cash.

- Spend the money.

Whether the company's stock price goes up or down, you will receive those dividend payments as long as the company continues to disburse them. The beauty of stocks that pay dividends is that part of your return includes predictable quarterly payments.

Not every company offering dividend stocks can maintain a dividend payout in every economic environment, but a diversified portfolio of dividend stocks can produce reliable income, rain or shine. Combine those dividends with capital appreciation as the companies you own grow in value, and the total returns can rival and even exceed those of the broader market.

Examples

Examples of dividend stocks

Here are some well-known companies with a long history of paying dividends, along with their dividend yields at recent stock prices and the per-share amount of each dividend:

| Company | Industry | Dividend Yield | Quarterly Dividend Amount |

|---|---|---|---|

| Chevron (NYSE:CVX) | Energy | 4.11% | $1.71 |

| Procter & Gamble (NYSE:PG) | Consumer defensive | 2.47% | $1.006 |

| Lowe's (NYSE:LOW) | Consumer cyclical | 1.95% | $1.15 |

Both Procter & Gamble and Lowe's have increased their stock dividends for more than 50 consecutive years, placing them in an elite group of companies known as the Dividend Kings. They're also part of the Dividend Achievers, a trademarked property owned by Nasdaq. Dividend Achievers are S&P 500 index companies with more than 10 years of consecutive dividend increases.

Chevron has a 38-year streak of dividend growth. Dividend stocks can come from just about any industry, and the amount of the dividend and percentage yield can vary greatly from one company to the next.

Key metrics

Dividend yield and other key metrics

Before you buy any dividend stocks, it's important to know how to evaluate them. These metrics can help you understand how much in dividends to expect, how reliable a dividend might be, and -- most importantly -- how to identify red flags.

Dividend yield

The dividend yield is the annualized dividend represented as a percentage of the stock price. For instance, if a company pays $1 in annualized dividends and the stock costs $20 per share, the dividend yield would be 5%.

Yield is useful as a valuation metric when you compare a stock's current yield to its historical levels. A higher dividend yield is better, all other things being equal, but a company's ability to maintain the dividend payout -- and, ideally, increase it -- matters even more. An abnormally high dividend yield could be a red flag.

Dividend payout ratio

This is the dividend as a percentage of a company's earnings. If a company earns $1 per share in net income and pays a $0.50-per-share dividend, the dividend payout ratio is 50%. In general terms, the lower the payout ratio, the more sustainable a dividend is.

Cash dividend payout ratio

This is the dividend as a percentage of a company's operating cash flows minus capital expenditures, or free cash flow (FCF). This metric is relevant because GAAP (generally accepted accounting principles) net income is not a cash measure.

Various noncash expenses can cause a company's earnings and FCF to vary significantly from one period to the next. This variability can cause a company's payout ratio to be misleading at times. Investors can use the cash dividend payout ratio, along with the simple payout ratio, to better understand a dividend's sustainability.

Total return

This is the increase in stock price (known as capital gains) plus dividends paid. For example, if you pay $10 for a stock that increases in value by $1 and pays a $0.50 dividend, then that $1.50 you've gained is equivalent to a 15% total return.

Earnings per share (EPS)

The EPS metric normalizes a company's earnings to the per-share value. The best dividend stocks are companies that have shown that they can regularly increase earnings per share over time and thus raise their dividend. A history of earnings growth is often evidence of durable competitive advantages.

Price-to-earnings (P/E) ratio

The price-to-earnings (P/E) ratio is calculated by dividing a company's share price by its earnings per share. This metric, along with dividend yield, can be used to determine whether a dividend stock is fairly valued.

High yield

High yield isn't everything

Inexperienced dividend investors often make the mistake of buying stocks with the highest dividend yields. While high-yield stocks aren't bad, high yields can be the result of a stock's price falling due to the risk of the dividend being cut. That's called a dividend yield trap. Here are some steps you can take to avoid falling for a yield trap:

- Avoid buying stocks based solely on dividend yield. If a company has a significantly higher yield than its peers, that's often a sign of trouble, not opportunity.

- Use the payout ratios to gauge a dividend's sustainability.

- Use a company's dividend history of payout growth and yield as a guide.

- Study the balance sheet, including debt, cash, and other assets and liabilities.

- Consider the company and industry. Is the company's business at risk from competitors, weak demand, or some other disruption?

Sadly, a yield that looks too good to be true often is. It's better to buy a dividend stock with a rock-solid lower yield than to chase a high yield that may prove illusory. Moreover, focusing on dividend growth -- a company's history and ability to raise its stock dividend -- often proves more profitable.

Taxes

How are dividends taxed?

Most dividend stocks pay qualified dividends, which are taxed at a 0%, 15%, or 20% rate, depending on your tax bracket. The range is significantly lower than the ordinary income tax rates of 10% to 37% or more. (An additional 3.8% tax is levied on certain investment income for the highest earners.)

Most dividends qualify for the lower tax rates. However, some are classified as "ordinary" or nonqualified dividends and are taxed at your marginal tax rate.

Several kinds of stocks are structured to pay high dividend yields and may come with higher tax obligations because of their corporate structures. The two most common are real estate investment trusts (REITs) and master limited partnerships (MLPs).

Of course, this extra tax burden doesn't apply if your dividend stocks are held in a tax-advantaged retirement plan such as an individual retirement account (IRA). However, investing in MLPs can sometimes leave you owing taxes, even on your IRA.

Strategies

Dividend investment strategies

There's a misconception that dividend stocks are only for retirees or risk-averse investors. That's not the case. When you start investing, you should consider buying dividend-paying stocks to reap their long-term benefits.

Dividend stocks, especially those in companies that consistently increase their dividends, have historically outperformed the market with less volatility -- expressed in a measure called beta. Because of that, dividend stocks are a great fit for almost every investor. They can help you create a diversified, wealth-building portfolio.

Beta

There are a few dividend strategies to consider. The first is to build a dividend portfolio as part of your overall portfolio. When building a dividend portfolio, it's important to remember that paying dividends isn't obligatory for a company in the same way that companies must make interest payments on bonds. So, if a company has to cut expenses, the dividend could be at risk.

You can't completely eliminate the risk of a dividend cut, but you can lower the risk. Focus less on a company's dividend yield and more on its ability to increase its dividend consistently. Look for a company with a sound financial profile focused on a growing industry.

Related investing topics

Another aspect of a dividend investing strategy is determining how you want to reinvest your dividends. Some investors opt to reinvest their dividends manually, while others use a dividend reinvestment plan (DRIP).

This powerful tool will take every dividend you earn and automatically reinvest it -- without fees or commissions -- into shares of that company. This simple set-it-and-forget-it tool is one of the easiest ways to use the power of time and compounding value to your advantage.

Another dividend investing strategy is to invest in a dividend-focused exchange-traded fund (ETF) or mutual fund. These fund options enable investors to own diversified portfolios of dividend stocks that generate passive income.

Exchange-Traded Fund (ETF)

No matter which dividend strategy you use, adding dividend stocks to your portfolio can be beneficial. They can help reduce volatility and boost your total returns so you can reach your financial goals a little faster.