There are several different investment return metrics you are likely to encounter. Annualized return is one popular metric, and you'll also see returns over a certain number of months or years -- for example, it's common for people to look at the five-year and 10-year returns of stocks or mutual funds.

Holding period return, also abbreviated as HPR, is another example that could be more useful to you as an individual investor. In a nutshell, holding period return is the metric that tells the gains you made on a particular investment. After all, you don't always hold investments for a specific block of time, like one year, so the holding period return looks at the entire time you've been invested.

How to calculate

How to calculate holding period return

Holding period return refers to the total return you've achieved on an investment in your portfolio for the entire time you've owned it. There are two components of your holding period return.

Most obvious is the gain (or loss) in the market value of the investment. For example, if you invest $1,000 into a stock and those shares are worth $1,200 a year later, you have a value gain of $200, or 20%.

The other component is the income you generate. If you own a stock that doesn't pay a dividend, you don't have to worry about this. However, with dividend stocks, bonds, mutual funds, or any other income-bearing investments, dividends should also be considered as part of your holding period return.

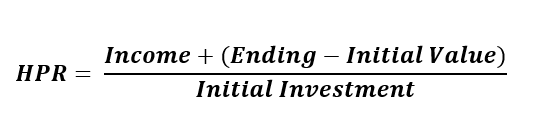

The general formula for holding period return is rather simple:

Simply add the investment's ending market value to the cumulative amount of income it generated in your portfolio and divide by the amount of money you initially invested.

It's also worth noting that if you automatically reinvest your dividends, you can simply use your investment's ending value in the numerator instead of adding up your income.

Example

Example of holding period return

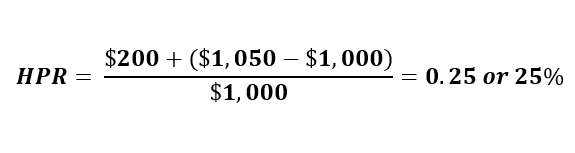

We'll look at two examples to illustrate this concept. First, consider a bond investment. We'll say you invest $1,000 in a 30-year Treasury bond that pays 4% interest ($40 per year). You hold the bond for five years, and its market value at the end of the five-year holding period is $1,050.

In this case, you can calculate your holding period return as follows:

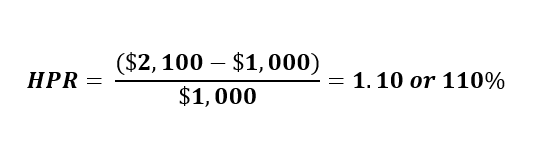

As another example, we’ll say that you invest $1,000 into a dividend stock and hold it for five years. For simplicity, we'll say that you receive a $10 quarterly dividend payment ($40 per year) but that your dividends are automatically reinvested to buy additional shares. At the end of five years, your investment is worth $2,100, and your holding period return is:

As mentioned, in cases involving dividend reinvestment, the income you received is already included in your investment’s ending value, so there's no need to consider it separately.

Related investing topics

Annualized return calculation

Calculating your annualized return from the holding period return

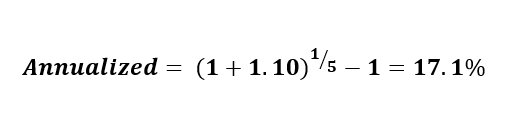

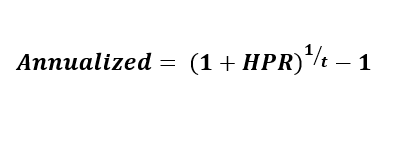

Finally, if you want to compare the performance of different investments in your portfolio (with different holding periods), one way to level the playing field is to calculate the annualized return over your holding period. The formula for this is:

Where “t” refers to your holding period in years.

To illustrate this, let's use the example of the dividend stock in the previous section that generated a 110% holding period return over five years in your portfolio. Using this in the formula and plugging it into a calculator shows: