The Glass-Steagall Act generally refers to provisions of the Banking Act of 1933 that sought to create a firewall between investment and commercial banking activities. Authored by Sens. Carter Glass of Virginia and Henry Steagall of Alabama, the act was a federal response to several banking practices that were blamed for the Great Depression. Read on to learn more about this important legislation and how its history has shaped the modern economy.

Overview

What is the Glass-Steagall Act?

Most references to the Glass-Steagall Act aren't referring to the Glass-Steagall Act at all -- they're generally referring to provisions of the Banking Act of 1933 that required banks to separate commercial banking activity and investment banking activity. The provisions, pushed by Sens. Carter Glass of Virginia and Henry Steagall of Alabama, were a response to banking practices that helped bring about the Great Depression.

Although the stock market crash of 1929 is widely regarded to have triggered the Great Depression, the U.S. economy still was in deep trouble in 1933. In early March of that year, President Franklin D. Roosevelt -- after fewer than two days in office -- declared a bank holiday in a bid to stop runs on banks, which had hit New York financial institutions especially hard. An emergency banking act was passed within a week, and the larger measure, now known as Glass-Steagall, was signed by Roosevelt in June 1933.

Provisions

Provisions of Glass-Steagall

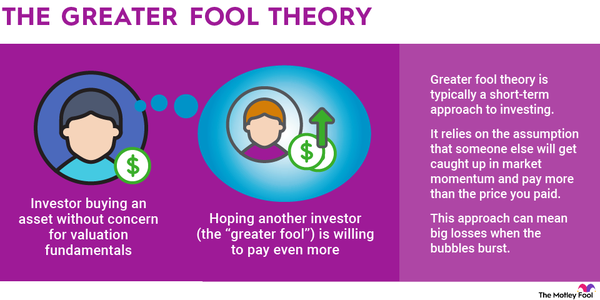

The best-known provision of the Banking Act, known as Glass-Steagall, required banks to create a firewall between investment banking and commercial banking activities. Before the measure passed, banks were allowed to lend money to companies and then sell their stock, creating an inherent conflict of interest.

A U.S. Senate probe known as the Pecora Investigation found that banks were allowed to mislead investors, sell stocks short, manipulate stock prices, underwrite and sell questionable securities, and make interest-free loans to insiders and favorite clients.

While the separation of investment and commercial banking remains the best-known provision of the law, the Banking Act featured another provision that has been credited with slowing bank runs that had plagued the country: the creation of the Federal Deposit Insurance Corporation (FDIC). When it was formed, the FDIC insured deposits of as much as $2,500 for Federal Reserve System banks; the figure was last increased to $250,000 in 2008.

Related investing topics

Aftermath

Aftermath of Glass-Steagall

The act was given credit for one of the longest periods of banking tranquility in the history of the country. In 1999, lawmakers passed the Financial Services Modernization Act, which effectively removed the barriers that separated commercial banking, investment banking, and insurance services.

The repeal is widely considered a major cause of the 2008-09 Great Recession, which marked the worst economic downturn since the 1930s. Prominent economists such as Joseph Stiglitz have argued that the repeal of Glass-Steagall encouraged commercial banks to behave more like investment banks and facilitated the creation of "too big to fail" financial institutions that had to be bailed out by massive amounts of government guarantees.

Others, however, like former President Bill Clinton (who signed the 1999 law), have argued that the repeal of Glass-Steagall had little to do with the financial crisis, claiming that the crisis was sparked more by bad bets on the U.S. housing market than the intermingling of commercial and investment banking.