Financial models provide businesses with an overview of their past, present, and expected future performance. It’s used by a wide range of financial professionals, including investment bankers, accountants, researchers, planners, and analysts. Read on to learn more about how financial models are built and used.

What is it?

What is financial modeling?

A financial model is a summary of a company’s financial performance that’s used to predict its future. The model can help a company predict a range of outcomes, such as quarterly earnings, monthly revenue, or annual net income.

Although models are useful for predicting performance, they can also be used for a wide variety of business functions. Models are frequently used to determine if it’s profitable to invest in another company, lend money to it, or launch a partnership with it.

Financial models are built with the three main accounting statements:

- Income statements display revenues and expenses. They also can include costs of goods sold, gross profit, earnings before income taxes, depreciation, and amortization (EBITDA), and net income.

- Balance sheets are used to report a company’s assets, liabilities, and shareholders’ equity, also known as a company’s book value.

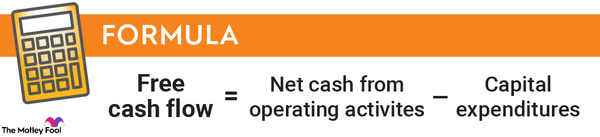

- Cash flow statements measure the money flowing into and out of a business, generally with sections for cash flows from operations, cash flows from investments, and cash flows from financing.

Types

Types of financial models

The type of financial model used depends on its purpose. Here are five common types of financial models:

- Three-Statement Model: Consists of the three major statements linked in Excel. The model is built so that a change in one statement is reflected in the other two.

- Discounted Cash Flow (DCF) Model: Uses cash flow from the Three-Statement Model to value a company, based on the net present value (NPV) of a businesses’ future cash flow.

- Merger and Acquisition (M&A) Model: Typically uses a single tab in a spreadsheet for each company and a separate tab for the entity resulting from the merger or acquisition.

- Initial Public Offering (IPO) Model: Used to value a business that’s considering becoming publicly traded and make assumptions about investor interest.

- Leveraged Buyout (LBO) Model: Builds debt schedules used to finance the acquisition into the model.

Pros and cons

Pros and cons of financial models

Well-designed financial models have a number of benefits, including:

- Identifying potential risks

- Highlighting opportunities for growth

- Providing a clear financial picture to potential investors

- Helping to allocate resources and determine budgets

- Report important information to shareholders

Financial models aren’t without risks, though, including:

- Input errors, caused by faulty manual entry or poorly designed code

- Incomplete data, caused by variables that aren’t considered or unknown

- Incorrect assumptions, either too optimistic or too pessimistic

- Unknown unknowns, or failures to account for uncertainties

- Missing scenarios, failing to consider possible what-if outcomes

Related investing topics

The bottom line

The bottom line on financial models

Financial models are created by gathering data from core financial statements, identifying factors that could affect future results, creating assumptions and scenarios, and testing the model for accuracy. A well-designed model can provide valuable information, both for internal use and external stakeholders; a poorly designed model can have the opposite effect. It’s important that financial models be designed, maintained, analyzed and vetted thoroughly before being used by decision-makers.