You hear a lot about economic indicators in the news, for better or worse, even if you never realized that’s what people were talking about. From a country’s gross domestic product (GDP) to its unemployment rate, economic indicators tell important stories about local and global economies.

What are economic indicators?

What are economic indicators?

Economic indicators are exactly what they sound like -- measurements that help to indicate how economies are faring. There’s no single economic indicator for any given situation or country, and many are used together in only specific circumstances, but they nonetheless have a lot to say.

For example, housing starts can be an economic indicator when you’re talking about the real estate market and how many homes are being constructed. It’s a very important indicator of the faith of home builders that buyers will be willing to pay for a new home, as well as a future indicator of sales activity of building supplies. However, if you’re more interested in how inflation affects consumers, this might not be a really useful metric, although it might add a bit of nuance to the picture.

Types

What are the types of economic indicators?

Economic indicators come in three forms: leading, lagging, and coincident. Each of these indicators is important to understanding the full picture since no single indicator can tell you how an economy is doing or if a recession is occurring, for example.

Leading economic indicators are used to help predict where the economy is going. They show you what’s possible if the indicator continues on that same trajectory. Lagging indicators are the opposite; they can show you where the economy has been and generally can only be measured after the fact, like unemployment rates for a particular area or country during a particular time frame.

Coincident indicators tend to happen in real time and are monitored as such. They are like windows into the economy’s actual functioning at any given time but are difficult to use to predict any future activity or to review mistakes (or successes) of the past. GDP is a coincident indicator that is often used to gauge where countries stand compared to each other.

How are they chosen?

How are economic indicators chosen?

Economic indicators are generally chosen by economists to help solve particular problems in economics. For example, if they wanted to know how well the United States was doing in manufacturing compared to China, they could easily compare specific indicators that speak to that industry in both countries. They might look at indicators that delve into different kinds of manufacturing activity or the cost of manufacturing and the debt load of manufacturing businesses.

There are dozens of commonly used indicators, so there’s always some bit of information that’s exactly what’s needed to approach an economic problem. Much like the right equations in math solve specific problems, these indicators can help answer questions about economies.

Expert views

Academic views on economic indicators

Domenico Ferraro, PhD

The Motley Fool: How do policymakers use economic indicators to guide monetary and fiscal policies?

Domenico Ferraro, PhD: “Policymakers use various economic indicators to assess the likely direction of the economy. Since nothing is known with absolute certainty, any predictions about the future carry a probabilistic component. Statistics and econometrics are powerful tools that are frequently employed for forecasting”

Wei Zhou, PhD

The Motley Fool: How do you use economic indicators to predict future economic trends?

Wei Zhou, PhD: “Economic indicators are essential tools for measuring macroeconomic performance and stability. Indicators such as GDP, inflation, unemployment, and consumer spending help forecast future economic trends.

- Gross Domestic Product (GDP): Measures the total value of a country's goods and services produced over a specific period. A growing GDP signals a healthy economy.

- Consumer Price Index (CPI): Tracks inflation; rising inflation can negatively affect consumer spending.

- Unemployment Rate: Considered a lagging indicator, as it typically follows economic growth or contraction with a delay. A high unemployment rate signals a downward trend in the economy.

- Consumer Spending: A key reflection of economic conditions, driving business performance and economic growth. Higher consumer spending boosts business activity and supports overall economic expansion.

Other important indicators include but not limited to, the Consumer Confidence Index, Corporate Earnings, Stock Market Performance, New Manufacturing Orders, Building Permits & Housing Starts, Industrial Production, and Retail Sales.”

The Motley Fool: How do policymakers use economic indicators to guide monetary and fiscal policies?

Wei Zhou, PhD: “Policymakers use a combination of economic indicators to identify trends and provide a clearer outlook on the economy. By analyzing patterns across multiple indicators, policymakers can assess whether the economy is in an expansion or recession phase, compare business cycles, and evaluate the impact of existing policies.

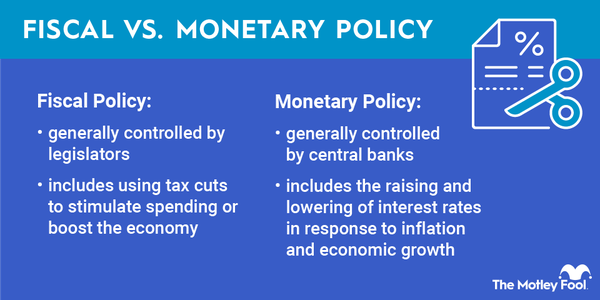

- Monetary Policy: The Federal Reserve (Fed) uses economic indicators to guide monetary policy. When inflation is high, the Fed may raise interest rates to slow borrowing and spending. Conversely, during periods of slow growth or recession, the Fed may cut rates to encourage borrowing and investment. In cases of rising unemployment, the Fed may increase the money supply to stimulate economic activity.

- Fiscal Policy: Governments influence economic demand through taxation and public spending. During a recession, governments often increase spending and reduce taxes to stimulate demand. Conversely, during inflationary periods, they may cut spending or increase taxes to cool the economy.

The Motley Fool: How can investors use economic indicators to make investment decisions?

Wei Zhou, PhD: “Investors closely monitor economic indicators to predict market shifts, adjust asset allocations, and optimize returns based on economic cycles. By keeping an eye on these indicators, investors can align their portfolios with prevailing economic conditions.

An effective strategy typically involves focusing on growth stocks and cyclical sectors during periods of economic expansion, while shifting to defensive stocks and bonds during recessions. During inflationary periods, investors may focus on commodities such as gold, oil, energy, agriculture, real estate, and inflation-linked bonds.”

Related investing topics

Important economic indicators

What are some important economic indicators?

There are many economic indicators that are frequently used in practice, but a few are commonly reported in the news and seen by investors as being particularly useful. These include:

- Consumer price index (CPI). The CPI measures how much it costs the average consumer to buy things based on a fixed basket of goods and services. When the CPI is high, customers have less buying power.

- Inflation rate. This economic indicator measures the change in prices over time and points to the value of money at any given time. If inflation is high, money is worth less for people, businesses, and governments.

- Producer price index (PPI). The PPI is related to the CPI. It measures how much manufacturers and other producers receive for their products and services. The PPI is from the producer’s perspective, as opposed to the CPI, which is from the consumer’s perspective.

- Non-farm payrolls. Non-farm payrolls help gauge the performance of workers outside of farming occupations. It’s a short-term measurement of job market performance and can predict future unemployment rates.

- Unemployment rate. The unemployment rate is a measure of the number of working-age people who are available for work but aren’t currently working and have generally taken specific steps to find a job. There are many ways to measure unemployment, but this indicator is generally a reliable way to gauge the health of the economy.