An earnings yield is a data point used to evaluate investment options. It stands out among a sea of financial metrics for being roughly comparable across asset classes -- meaning you can compare stock earnings yield to bond yield.

Learning how to calculate, interpret, and use an earnings yield helps you make well-rounded investment decisions. Let's explore the basics of this metric now.

Definition and formulas

Earnings yield definition and formulas

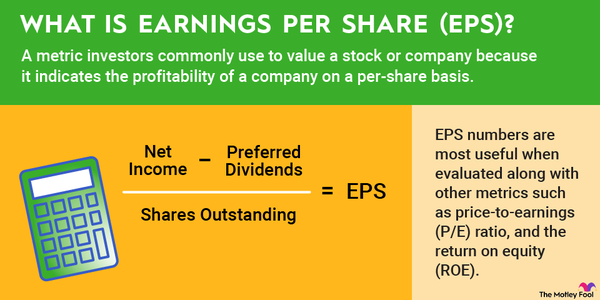

The earnings yield indicates an investment's valuation and potential return. To calculate a stock's earnings yield, divide the company's annual earnings per share (EPS) by the share price. You may recognize this formula as the inverse of the popular P/E ratio.

You can also calculate an earnings yield by dividing the company's market capitalization into net income. This formula produces the same answer as the EPS divided by the share price. The result is expressed as a percentage.

The earnings yield quantifies the company's prior 12-month income as a percentage of the stock price. Said another way, buying a stock with a 40% earnings yield means you've purchased $0.40 of annual earnings for each $1 you invested.

This value is most descriptive in comparisons. Use these guidelines to interpret relative earnings yield values:

- A higher earnings yield can indicate low valuation and higher potential returns. Two factors push an earnings yield higher: a falling stock price or rising earnings. If the yield is higher because the stock price has dipped, you should evaluate the permanence of the decline. A short-term pullback in the stock price can indicate a buying opportunity; a long-term decline is something to avoid.

- A lower earnings yield can mean the stock is overvalued and has less upside. However, an overvaluation relative to historic earnings can be justified when the company's growth expectations are high. Look into the company's outlook as a next step.

Using earnings yield

Using earnings yield

Earnings yields have two primary uses in financial analysis. The first is comparative. You can compare a stock's earnings yield to competitors, benchmarks, and other asset classes.

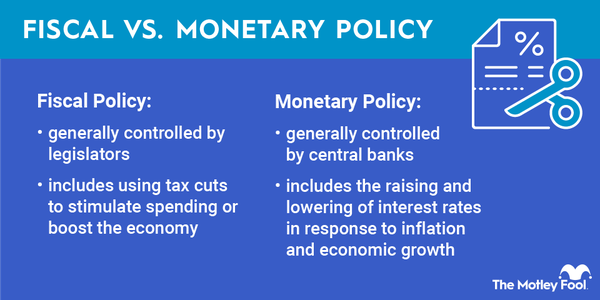

For example, analysts will compare the S&P 500 earnings yield to bond yields when evaluating the relative return potential of equity vs. debt investing. Often, the equity earnings yield is higher. The difference is called the equity risk premium -- which theoretically compensates equity investors for accepting the greater volatility of stocks vs. bonds.

Earnings yields are also an alternative to the P/E ratio for companies with negative earnings. Many financial publishers do not calculate or provide negative P/E ratios because their interpretation can be confusing. In these situations, the earnings yield is easier to compare and analyze.

Drawbacks

Drawbacks of earnings yield

Like most financial metrics, an earnings yield presents a limited view of a company's operations. Drawbacks to consider when evaluating a stock's earnings yield include:

- Backward-looking. Earnings yields typically rely on the company's prior 12-month earnings. There is no guarantee that performance will continue. You can alternatively calculate a forward earnings yield using projected income and the current share price. This will be an estimate only since actual results may differ from projections.

- Volatile. The earnings yield will change whenever the stock price or the EPS changes. This can make trend analysis difficult. You can alternatively calculate the yield with an average stock price and adjusted EPS. An adjusted EPS typically removes the effect of nonrecurring items.

- Limited usefulness in isolation. Earnings yields can vary widely across industries and geographies. As such, they don't reveal much when viewed in isolation. You can best identify a "good" earnings yield by comparing similar companies or assets.

Related investing topics

Example

Earnings yield example

To demonstrate these concepts, suppose you would like to add a new asset to your portfolio. You are considering either a corporate bond or shares of a stock with the ticker ABC. The bond yields 5%. Stock ABC trades for $250 and has a trailing 12-month EPS of $12.

The stock's P/E ratio is $250 divided by $12, or 20.8. You can compare this value to other stocks but not to the corporate bond.

When bonds are part of the comparison, an earnings yield is the more useful metric. Stock ABC's earnings yield is $12 divided by $250, or 4.8% -- which is lower than the corporate bond yield.

This does not automatically mean the bond is the better choice, however. Remember that the bond yield will not change over time, but a company's earnings potential can improve or decline. Your next step is evaluating Stock ABC's financial health and outlook relative to your timeline and risk tolerance.