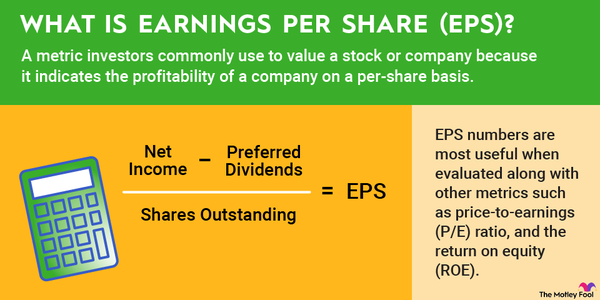

Earnings before interest and taxes (EBIT) is a company's revenue minus its expenses, excluding tax and interest. EBIT is essentially a financial metric that indicates profitability, making it useful for stock analysis.

What is it?

Understanding earnings before interest and taxes (EBIT)

To calculate a company's EBIT, start with its total revenue. This may be called net sales, depending on the company. Subtract the cost of goods sold/total cost of sales and the operating expenses. The result is the company's EBIT.

You won't find EBIT on a company's financial statements since it's not part of the generally accepted accounting principles (GAAP). However, you'll likely find operating income or operating profit, which are sometimes synonymous with EBIT.

If a company has no non-operating income, EBIT and operating income are the same. If a company has non-operating income, EBIT is the sum of its operating income and non-operating income.

Its importance

Why EBIT is important

Profitability is a crucial factor in any business's long-term success. While start-ups and early-stage companies sometimes operate at a loss initially, quality businesses make more than they spend. The amount of profits a company earns also determines how much it can expand, invest in research and development, and return to shareholders in the form of dividends or stock buybacks.

EBIT provides a way to measure profitability and track its changes over time. Because it excludes taxes and interest, it shows whether a company's earnings are enough to finance its operations. It also allows you to compare companies that pay different tax rates.

How to use it

How to use EBIT

EBIT can help you evaluate a company's growth and compare multiple companies within the same industry. To see profits over time, you can look at EBIT in multiple quarterly or annual financial statements. Ideally, EBIT will be increasing; if not, you'll want to see why profits haven't been growing for that period.

You can also use EBIT to directly compare companies in terms of their profitability and operational efficiency. If two companies are direct competitors, and one has a significant edge in EBIT, that's a strong point in its favor as an investment.

However, remember that this only works if the companies are in the same market sector. Some industries have much higher EBITs than others on average. It wouldn't make sense to compare the profits of tech companies, which have some of the highest EBITs, to utility companies.

It's also worth remembering that EBIT is just one of many important financial metrics. For example, there's also earnings before interest, taxes, depreciation, and amortization (EBITDA). Among companies with high fixed assets, EBITDA is a useful metric for looking at profitability before depreciation deductions.

Example

Example of EBIT

As mentioned, you can find or calculate EBIT from the information on a company's financial statements. To give you an example, we can look at the annual 10-K filing for Apple (AAPL -3.82%) in the 2024 fiscal year. Under its consolidated financial statements, it reported:

- $391.035 billion in total net sales

- $210.352 billion for total cost of sales

- $57.467 billion in total operating expenses

By subtracting the total cost of sales and total operating expenses from Apple's total net sales, we get its EBIT of $123.216 billion. Apple also provides this information in its operating income field, along with operating income for the last two fiscal years, so you can easily compare recent numbers.