Dogecoin (CRYPTO:DOGE) is a cryptocurrency that was originally created as a joke in 2013. Its origins goes back to the Doge meme that featured a Shiba Inu dog. Dogecoin is an open-source, peer-to-peer digital currency. Like other cryptocurrencies, it runs on blockchain technology.

What is it?

What is Dogecoin?

Dogecoin is a cryptocurrency known for its robust and loyal online community, known as the "Doge Army." Dogecoin uses the Scrypt algorithm, a proof-of-work algorithm that's used to secure transactions and improve storage efficiency.

Dogecoin is also classified as an altcoin, which is a term used to refer to a cryptocurrency that's not Bitcoin (BTC 0.83%). Because Dogecoin has an unlimited supply, long-term price stability is extremely difficult. The more tokens that are created, the lower the price of those tokens go. Dogecoin can be purchased on most crypto exchanges.

History

The history of Dogecoin

Dogecoin was created by software engineers Billy Markus and Jackson Palmer in December 2013 using open-source code. Markus was a software developer at IBM and Palmer was a product manager at Adobe.

Dogecoin was forked from Litecoin (LTC 0.76%). In cryptocurrency, a fork is when the blockchain's code is updated or split into two separate chains. Forks can be used to add new features or create new cryptocurrencies, the latter of which was how Dogecoin came to be.

While Dogecoin originated as a satirical response to the cryptocurrency hype, it witnessed a price increase of more than 300% in its early days. Then in 2021, Dogecoin hit an all-time high around $0.73 a share on the back of social media buzz from both retail and prominent investors.

How it works

How does Dogecoin work?

Dogecoin operates on blockchain technology, where transactions are recorded on a decentralized public ledger maintained by a network of computers. This allows users to send and receive Dogecoin securely without the need for a central authority. New Dogecoins are created through mining, a process that involves solving complex math equations to validate transactions on the Dogecoin blockchain.

The fastest miner to confirm a transaction receives the mining reward of 10,000 Dogecoins per block. Cryptocurrency mining is the process of using computers to generate new coins and verify transactions on a blockchain network. Miners are then rewarded with cryptocurrency for their work.

Dogecoin relies on the proof-of-work algorithm to verify transactions, where miners compete to solve complex computational puzzles to validate transactions and add new blocks to the blockchain. Mining Dogecoin requires specialized hardware like graphics processing units (GPUs) with high computational power.

Users store their Dogecoin in digital wallets, which are essentially private keys that allow them to access and manage their funds. When a user wants to send Dogecoin, they initiate a transaction by providing the recipient's public address. The transaction is broadcast to the network and verified by miners. The transaction is then added to the blockchain, and the recipient receives the Dogecoin.

Related investing topics

Use cases

Dogecoin use cases

Dogecoin can be used for tipping, online transactions, and even charitable donations. The token has also become a popular way to tip content creators on social media platforms like Reddit (RDDT -1.16%).

Some online retailers accept Dogecoin as payment, while a handful of companies allow customers to even pay bills and utilities using the crypto. Dogecoin has low transaction fees and fast payment processing times, which makes it a good option for some businesses who want to tap into the crypto’s large community of supporters.

Unlike many other cryptocurrencies, Dogecoin has no maximum cap on the number of coins that can be created. For example, Bitcoin has a finite supply of 21 million coins. New Dogecoins can be mined indefinitely, with roughly 10,000 new coins being generated every minute, resulting in a constantly growing supply.

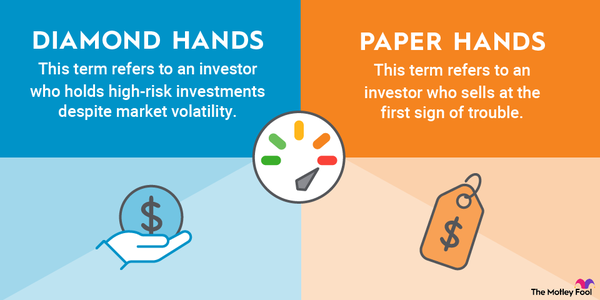

These factors, plus the limited uses around the coin that still derives most of its value from hype, mean Dogecoin is a volatile, high-risk investment. Potential investors should bear these factors in mind before putting cash to work in this token.