For more income and stability in your investment portfolio, consider corporate bond exchange-traded funds (ETFs). Let's review how these bond funds work, what they can bring to your investing strategy, and how to evaluate your options. We'll also share an overview of three popular corporate bond ETFs that may suit your investing needs.

Understanding corporate bond ETFs

Understanding corporate bond ETFs

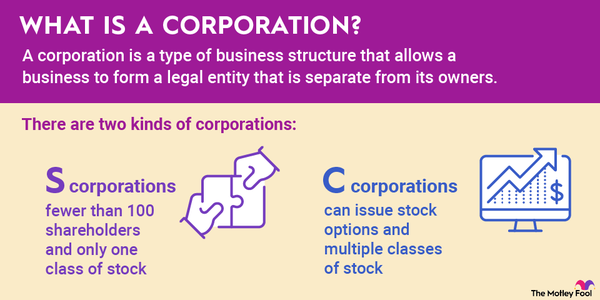

Corporate bond ETFs are funds that invest in business-issued debt securities. These funds are exchange-traded, meaning fund shares are bought and sold throughout the trading day like stocks.

Types of corporate bonds

Corporate bonds can vary in credit quality, maturity, and currency. Quality categories include investment-grade and high-yield. Investment-grade bonds have higher credit ratings and lower risk of default. High-yield bonds are riskier and, accordingly, pay higher yields.

Maturities on corporate bonds can be short-term, medium-term, or long-term. Short-term maturities range from one year to four years. Medium-term bonds mature in four to 10 years, and long-term bonds are repaid in 10 years or more. Shorter maturities generally have lower risk.

Corporate bonds can also be denominated in U.S. dollars or any other currency. Foreign currency bonds tend to be riskier than domestic bonds.

Passive corporate bond ETFs

Many corporate bond ETFs are passively managed. This means they are managed to mimic the performance of an index, such as the Bloomberg U.S. Corporate Bond Index. An index is a group of securities used as a benchmark for evaluating market segments and other securities.

Passively managed corporate bonds have low expense ratios, an advantage for shareholders. The expense ratio quantifies fund expenses you pay as a shareholder. Since these expenses dilute returns, lower is better.

Advantages

Advantages of investing in corporate bond ETFs

Corporate bond ETFs have several features that appeal to investors:

- Diversified. ETFs are more diversified than individual positions. Even ETFs specializing in one niche of corporate bonds will hold multiple securities within that niche. As a result, investors get exposure to a range of bonds within a single ETF position.

- Low maintenance. Owning and managing an ETF is simpler than overseeing a portfolio containing dozens of individual bonds.

- Accessible. You don't need to be an accredited investor to buy corporate bond ETFs. You only need a brokerage account or IRA with access to exchange-traded funds.

- Yield. Corporate bonds are riskier than U.S. government bonds, but they pay higher yields. Yield is the annual income as a percentage of the share price. Higher yield means more income per dollar invested.

Evaluation

Evaluating corporate bond ETFs

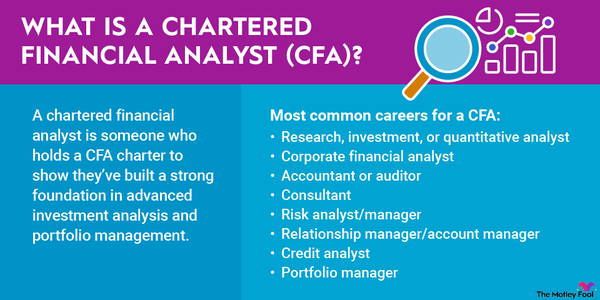

There are dozens of corporate bond ETFs available. Their portfolios vary in yield, maturity, and credit quality. To choose the right one, consider evaluating your fund choices on investment objective, expense ratio, fund size, risk level, and yield.

- Investment objective. Most ETFs state their objective prominently online and within the fund prospectus. The objective usually describes the types of assets in the fund and, if applicable, references a benchmark index. Review the objective and the index carefully to ensure they align with your goals.

- Expense ratio. If two ETFs have the same portfolio, the one with the lower expense ratio will deliver higher returns. Prioritize funds with low expense ratios to maximize your investment.

- Fund size. Popular funds have billions in assets under management. These large funds are quick to sell when you need to liquidate.

- Risk level. Check the fund documentation for a risk assessment. Also, review risk ratings on third-party tools like Morningstar. Consider eliminating any options that feel too risky before you compare yields.

- Yield. You may be investing for maximum yield, but this factor should be the last thing you assess about a fund. Only compare your options on yield after you've created a shortlist of funds that suit your goals and risk tolerance.

Examples

Examples: Three popular corporate bond ETFs

The table below includes three popular corporate bond ETFs, with notes on the five evaluation parameters.

| Factor | Vanguard Intermediate-Term Corporate Bond ETF (NASDAQMUTFUND:VICBX) | Vanguard Short-Term Corporate Bond ETF (NASDAQMUTFUND:VSCSX) |

iShares iBoxx $ Investment-Grade Corporate Bond ETF (NYSEMKT: LQD) |

|---|---|---|---|

| Objective |

Invests in investment-grade corporate bonds with maturities of five to 10 years. |

Invests in investment-grade corporate bonds with maturities of one to five years. |

Invests in U.S. dollar, investment-grade corporate bonds with a range of maturities. |

| Expense ratio | 0.04% | 0.04% | 0.14% |

| Net assets (size) | $50.8 billion | $41.5 billion | $28 billion |

| Risk level | Conservative | Conservative | Moderate |

| SEC 30-day yield | 5.42% | 4.89% | 5.48% |

As you can see, the three funds have different portfolios, expense ratios, and yields. Notably, the highest-yield fund is also the highest risk. The iShares iBoxx fund is the only one that includes long-term maturities.

Long-term maturities are riskier because they can be more sensitive to market interest rate changes. Bond pricing moves inversely to interest rates, so higher rates push bond prices down and vice versa.