An investing strategy is a plan of action that helps investors decide how to allocate their money based on their goals and risk tolerance. Every investor must decide for themselves their preferred investing preferences and the assets they want to purchase as they construct their portfolio.

Investing for the long term can be a superior way to build and maintain portfolio returns over the years. Usually, this means investing in quality companies across a diverse range of sectors and industries that involve a minimum buy-and-hold period of three to five years.

The buy low, sell high strategy can be incorporated into an effective long-term investing thesis, but this widely used phrase may not be as simple in practice as it appears. Here's what investors need to know.

Overview

What is the buy low, sell high strategy?

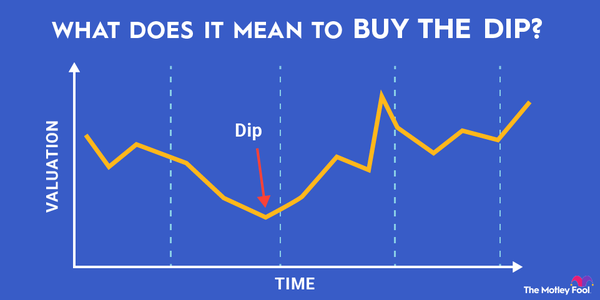

The buy low, sell high strategy is an old adage for purchasing an asset (like a stock) at a relatively low price and selling it down the line when the price has increased. This can allow investors to achieve a profit by capitalizing on the price difference between when they bought the asset and eventually sold it.

Usually, the goal of investors who apply this strategy is to identify undervalued assets and buy them, then wait for the price to rise before selling them for a profit. To successfully implement this strategy, investors need to analyze market trends and identify potential opportunities to buy low and sell high.

How it works

How a buy low, sell high strategy works

It is impossible to predict with exact accuracy what a stock price will or won't do. Patience is key, and prioritizing a long-term strategy built around investing in quality businesses rather than focusing solely on stock prices is vital to constructing a profitable, durable portfolio. There are numerous characteristics of a long-term investing thesis that can inform a realistic buy low, sell high strategy.

One is to diversify among growth, value, and dividend stocks while engaging in consistent investing strategies such as dollar-cost averaging. Most investors want to find companies trading at a decent valuation that have the potential to deliver tremendous growth and outpace the price at which they bought them over the long run.

To identify undervalued stocks, you should look at a company's ratios, dividend yield, and cash flow. You can also consider the company's market cap, competitors, and industry.

Considerations

Considerations for a buy low, sell high strategy

A stock may be undervalued when its current market price is significantly lower than its perceived intrinsic value, often indicated by a low price-to-earnings (P/E) ratio and/or a low price-to-book (P/B) ratio. A high dividend yield can also be an indicator of an undervalued stock when a company is paying out a significant portion of its earnings as dividends relative to the stock price.

Another key metric to consider is return on equity (ROE), which can tell investors whether a company is generating notable profits compared to its shareholder equity. A high ROE can indicate robust financial performance and potentially indicate that a stock is undervalued.

Beyond these metrics, an effective buy low, sell high strategy should also include a thorough review of a company's financial health, including its revenue, earnings, debt levels, and cash flow, to understand its intrinsic value. You should also compare the company's valuation metrics to those of other companies within its industry to gauge if it appears undervalued relative to its peers.

Related investing topics

Developing the strategy

Building a buy low, sell high strategy

No investment strategy or approach is perfect. Investing takes time and patience, and few investors will strike it rich overnight. If you buy a stock at $50 and later sell shares at $75 a share, you've made a 50% profit, but those numbers tell you very little about the underlying asset that you've been holding. The most effective buy low, sell high strategy is one that involves regularly investing in quality companies that can deliver portfolio growth over many years.

This is much better than trying to time the market or engage in short-term trades that are inherently much riskier and carry the likelihood of significant losses. It's also important to incorporate a margin of safety when you search for stocks that you can buy low and sell high. This investing principle can protect investors from losses by purchasing securities when their market price is below their intrinsic value.

A stock's intrinsic value is the real worth of a company's shares based on its financial fundamentals, such as cash flow, assets, and earnings. Comparing a stock's intrinsic value to its market price can help investors identify if a stock is overvalued or undervalued, increasing the chances of buying a stock low and selling it high in the future.

Many factors can affect stock prices, including supply and demand, company performance, and investor sentiment. By taking the time to study, evaluate, and identify undervalued stocks underpinned by promising, profitable businesses, you can thoughtfully and gradually build your portfolio around companies that align with your long-term investment objectives.