In the world of mergers and acquisitions (M&A), accounting practices are important, and no accounting practice is more important to gauging an M&A deal than the acquisition method. When dealing with different companies that are sometimes in different countries, accounting can get messy and sometimes fudgy.

By using the acquisition method of accounting, investors can get a good idea of the true nature of an acquisition. But how does it work and how do you use it? Let's break it down below.

What is it?

What is the acquisition method?

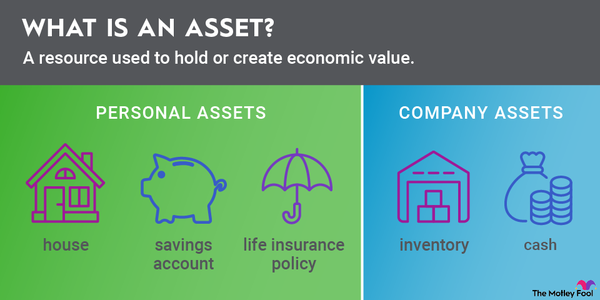

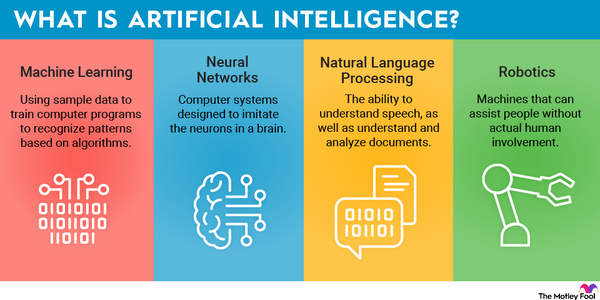

The acquisition method is a standard accounting approach used to record business combinations. This process takes standard methods of asset and liability calculations and combines them with less tangible metrics, like a company's brand value (goodwill), or less than the assumed market value for a company in a distressed situation (bargain purchase).

This approach aligns with generally accepted accounting principles (GAAP) and international financial reporting standards (IFRS), which allow fair, standardized reporting across the global financial markets.

The acquisition method replaced the purchase method under U.S. GAAP to improve transparency and consistency in how companies record and account for M&A. Under the old GAAP method, companies could allocate acquisition costs in ways that sometimes obscured the true economic impact of a deal.

Its importance

Why is the acquisition method important?

The acquisition method replaced the purchase method because the old method allowed companies to fudge the numbers a bit. Some businesses could hide certain costs or spread them out in ways that made their deals look better.

With the new method, all assets, liabilities, and goodwill must be recorded at their real value, with no tricks. Think of it like buying a used car: Under the old method, you could say the tires were worth more and the engine was worth less to make the deal look better on paper, but now, you have to report the exact value of each part.

The acquisition method doesn't just change how companies record deals. It also affects financial ratios, taxes, and business strategy. Since everything is measured at fair value, companies might see higher depreciation and amortization costs, which can eat into profits over time.

Goodwill, which is the extra money paid beyond an asset's fair value, isn't slowly written off like before but instead is tested every year to see whether it's still worth what the company thought. If the acquired company struggles, goodwill might take a hit, lowering reported earnings and making investors nervous. This setup forces businesses to keep an eye on whether their acquisitions are actually paying off.

How to use it

How to use the acquisition method and apply it effectively

When a company buys another business, following the acquisition method is an important step for keeping everything in line with accounting rules and making smart financial decisions. The first step is figuring out who's in charge -- that is, whoever gains control and is considered the acquirer.

Next comes setting the acquisition date, which is important because it decides when the acquired company's financials are added to the books. After that, the acquiring company must measure everything it's getting, including assets, liabilities, and any ownership stake that remains with previous investors.

Once the numbers are set, the next question is whether the buyer paid more or less than what the acquired company is technically worth. If the purchase price is higher, the extra amount is recorded as goodwill, representing the premium paid for things like brand reputation or customer loyalty.

If the buyer gets a deal and pays less than fair value, that difference is recorded as a bargain purchase gain, meaning the acquirer instantly books a profit on the deal. Finally, all of this is rolled into the acquiring company's financial reports, which means adjusting earnings to reflect these fair value changes.

To get this right, companies must be thorough in their valuations. Underestimating assets or overpaying can lead to later write-downs, which hurt reported profits and investor confidence. That's why businesses often bring in financial experts and auditors to make sure everything is properly accounted for, reducing the risk of surprises down the line.

Example

Real-world example: Amazon's purchase of Whole Foods

A classic example of the acquisition method in action is Amazon's (AMZN -2.58%) $13.7 billion purchase of Whole Foods in 2017. Using this approach, Amazon recorded the fair value of everything Whole Foods owned and owed, plus a hefty chunk of goodwill. In this case, goodwill was the amount of money Amazon paid for the Whole Foods brand, its loyal customers, and its potential for future growth.

Related investing topics

By following the acquisition method, Amazon kept everything GAAP-compliant, gave investors a clear financial picture, and fully absorbed Whole Foods into its business. It can't be stressed enough how beneficial the acquisition accounting method is for retail investors in publicly traded companies like Amazon.

The acquisition method gives a fuller picture that was otherwise sometimes obscured. Any business looking to grow through acquisitions needs to understand it or risk costly mistakes when integrating new assets.