Founded in 2009 by entrepreneur JoeBen Bevirt, Joby Aviation (JOBY -1.7%) develops electric vertical takeoff and landing (eVTOL) aircraft. Also known as flying taxis, its eVTOL aircraft are designed to travel more than 100 miles with a single charge and be quiet enough to land in a neighborhood. The Joby eVTOL is intended to take a pilot and four passengers at speeds of up to 200 miles per hour.

The goal is to enable journeys that are as much as five times faster than driving while also utilizing the thousands of airport and heliport facilities already in existence across the country. In developing electric air taxis for commercial service, Joby Aviation is in the process of certifying its aircraft with the U.S. Federal Aviation Administration (FAA). Joby is the first eVTOL manufacturer to complete three of five stages of the FAA-type certification program and is more than 40% complete with the fourth stage.

The company recently received the FAA Part 141 certificate for its Joby Aviation Academy, allowing it to build out a cohort of qualified pilots before commercial operations officially commence. Joby Aviation is also working with regulators around the globe, including in the United Kingdom, United Arab Emirates, Japan, and South Korea, as it seeks to commercialize its air taxi operations internationally.

Joby Aviation already has notable partnerships in place with commercial as well as government entities for its air taxi services, including Delta Air Lines (DAL -0.47%), Toyota Motor Corporation (TM 0.52%), Uber Technologies (UBER -1.34%), the U.S. Department of Defense, and the aviation subsidiary of Saudi Aramco. Joby Aviation began initial service operations with the U.S. Department of Defense in September 2023 and is hoping to launch commercial passenger operations in 2025.

Joby Aviation went public in August 2021 after completing a reverse merger with a special purpose acquisition company (SPAC). While it's been a turbulent ride for investors since that initial public offering (IPO), you might be wondering how to invest in Joby Aviation stock, whether the company generates revenue or profits, and more. Let's take a closer look.

Stock

How to invest

How to buy Joby Aviation stock

Because Joby Aviation is publicly traded, you can buy shares like you would any other U.S.-listed stock. Here's what you need to know to buy Joby Aviation stock.

Step 1: Open your brokerage app

Log into your brokerage account where you handle your investments. If you don't already have a brokerage account, you'll need to open one, but you can do so in just a few moments. To open a brokerage account, you typically need to provide your legal name, current address, Social Security number, date of birth, and other personal details.

You can use any brokerage that works for you, but it's worth taking the time to study the pros and cons of each platform you consider before deciding which one is right for you.

Step 2: Search for the stock

Enter the stock ticker (JOBY) or the company name, Joby Aviation, into the search bar to bring up the stock's trading page. You should only get to this step after you have funded your account and are ready to buy shares.

Step 3: Decide how many shares to buy

Consider your investment goals and how much of your portfolio you want to allocate to Joby Aviation stock. If you don't already allocate money to investing in stocks regularly, make sure you're not using funds you expect to need anytime soon, such as for bills or other financial obligations.

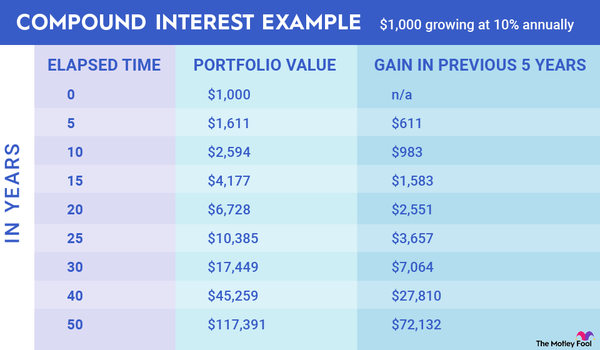

You should have a minimum buy-and-hold horizon of three to five years or more to give your investment time to compound.

Step 4: Select order type

Choose between a market order to buy Joby Aviation stock at the current price or a limit order to specify the maximum price you're willing to pay. A market order fills your order at the stock's current price. While a limit order allows you to set the maximum amount you're willing to pay, the order may not go through at all if shares never hit the price you specify.

Step 5: Submit your order

By this point, you should be well acquainted with Joby Aviation's business model from your research and its growth prospects and risks. You need to take the time to research any stock you're considering before you hit the buy button.

Understand the company, why you're buying it, and where it fits into your overall investment thesis. If you are unsure or don't fully understand what you're buying, take time to ensure you have a fully developed thesis before you hit the buy button. If you have researched and confirmed these details, you're ready to submit your buy order for Joby Aviation stock.

Step 6: Review your purchase

Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly. You should always aim to build a portfolio of 25 or more stocks across different industries/sectors. A good rule of thumb is to ensure no single stock comprises more than 10% of your portfolio.

Should I invest?

Should I invest in Joby Aviation?

As a company that is barely out of the pre-revenue stage and still needs to secure authorization from the FAA and other regulatory agencies, risk-averse investors might be less inclined to buy shares of Joby Aviation. However, if you're an investor with a healthy risk tolerance and an interest in buying into an up-and-coming air taxi company that already has established partnerships with commercial and government enterprises, Joby Aviation might be worth at least a modest investment.

Joby Aviation got its first big break back in 2012 when it was selected to collaborate with NASA on numerous electric flight projects. These included the X-57 (the agency's first all-electric experimental aircraft, which was later canceled due to propulsion system issues) and the Leading Edge Asynchronous Propeller Technology (LEAPTech) program, which is designed to help transition the aircraft industry to electric propulsion. In 2020, Joby became the first eVTOL company to receive airworthiness approval from the U.S. Air Force.

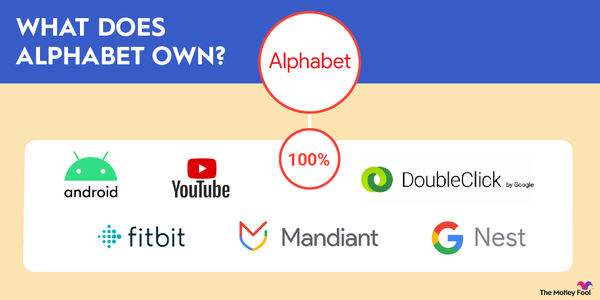

That same year, Joby expanded its partnership with key investor Uber. It acquired Elevate, the flying car division of the ridesharing giant, and agreed to integrate its aerial ridesharing service into the Uber app across all U.S. launch markets. In 2022, Joby signed a multiyear, multicity partnership with Delta Air Lines to deliver home-to-airport air taxi services. In June 2023, SK Telecom (SKM 2.69%), South Korea's top telecommunications conglomerate, invested $100 million in Joby. SKT also operates a network of navigation systems, EV charging locations, and rideshare assets that could be particularly helpful as Joby scales out its operations.

Toyota has also invested about $400 million in Joby Aviation so far. In September 2023, Joby Aviation made its first delivery to the Air Force as part of its $131 million contract to deliver and operate aircraft for the Department of Defense. Joby's only current operations are for the Department of Defense, although it hopes to launch commercial passenger operations in 2025. This means that the company reports barely any revenue and operating losses are considerable. In the first nine months of fiscal 2024, Joby reported revenue from flight services of $81,000, compared to total operating losses of about $447 million.

As Joby scales out its operations, the company does not plan to sell its aircraft to individual customers or independent third parties as its core business model. Its future business model will instead rely on manufacturing, operating, and owning its aircraft so it can build a vertically integrated transportation company that will deliver these services directly to customers. These services could range from commercial entities to government agencies.

Joby operates its own engineering, manufacturing, and flight test facilities in California. By controlling all stages of its production and distribution process, Joby Aviation hopes to maximize revenue potential down the line and build a network of eVTOL aircraft that powers its own in-house aerial ride sharing service. The company is working on creating a Joby Aviation app so that consumers can book rides directly in addition to bookings made with third parties through existing partnerships with companies like Delta and Uber.

Profitability

Is Joby Aviation profitable?

Joby Aviation is still in the early stages of developing and testing aircraft for commercialization. The company is generating hardly any revenue at this point, so any potential profits will be on a very distant horizon, more likely than not in the 2030s. However, the company had about $710 million in cash and investments on its balance sheet at the end of the third quarter of 2024.

Dividends

Does Joby Aviation pay a dividend?

Joby Aviation does not pay a dividend, and management has not signaled any plans to pay one. Since it's a company that is just getting out of its pre-revenue stage and is not yet profitable, investors should not expect dividends anytime soon.

ETFs

ETFs with exposure to Joby Aviation

If you’d like to invest in Joby Aviation stock without purchasing individual shares, you can do so by investing in an exchange-traded fund (ETF) that holds shares of the company. A few examples include the iShares Russell 2000 Growth ETF (IWO -1.39%), the Exchange Traded Concepts Tr-Global Robotics & Automation Index ETF (ROBO -2.15%) and the Ark ETF Tr-ARK Autonomous Technology & Robotics ETF (ARKQ -2.61%).

Exchange-Traded Fund (ETF)

Stock splits

Will Joby Aviation stock split?

Joby Aviation went public via a reverse merger with a SPAC in 2021. Shares have historically traded at or below $10. There are no plans to split the stock anytime soon.

Related investing topics

The bottom line on Joby Aviation

While it started limited operations for the U.S. Department of Defense in late 2023, Joby Aviation is not yet transporting commercial passengers and is working to achieve full FAA certification for its aerial taxis. The company is reporting hardly any revenue and is hemorrhaging losses, although both of these realities are to be expected for a company at this stage of its growth story.

With those risks being considered, Joby Aviation could disrupt the emerging aerial taxi industry. Its partnerships with some of the biggest names in the commercial transportation world and its collaborations with governments around the world could enable it to fulfill its goals of becoming a global powerhouse in the aerial taxi space.

Joby's stock could see significant gains if it can secure authorization from the FAA and other regulatory agencies, achieve successful commercial deployment, and generate revenue from its planned vertically integrated business model. This is a highly speculative play, but long-term investors with a sizable buy-and-hold horizon and some extra cash to spare for a well-diversified portfolio might want to take a second look.

FAQ

Investing in Joby Aviation FAQ

How to invest in Joby Aviation stock?

You can buy shares of Joby Aviation through your brokerage account, like you would any other stock.

Is Joby Aviation a good stock to buy?

Joby Aviation is a very speculative stock, but it is a notable player in the emerging aerial taxi industry.

Does Joby Aviation pay dividends?

Joby Aviation does not pay any dividends.

Is Joby Aviation a publicly traded company?

Joby Aviation is publicly traded under ticker symbol JOBY.