With its portfolio of industry-leading brands, Stellantis (STLA -1.33%) is a well-known automotive name. So, understandably, car stock enthusiasts are consistently drawn to it. The corporation has a considerable global presence as the parent company of famous American brands, like Jeep, Chrysler, and Dodge; well-known French names, like Citroen and Peugeot; and legendary Italian brands, like Alfa Romeo and Maserati.

While you may recognize the names in the Stellantis portfolio, you may be less familiar with the corporation itself. Stellantis was formed after a merger between Fiat Chrysler Automobiles (FCA) and French carmaker PSA and started operating in its current iteration in 2021. But many of its brands have far longer histories.

Stellantis produces traditional internal combustion engine vehicles, but the company is also committed to offering an increasing number of electric vehicles (EVs). In 2024, the company had more than 45 battery-powered EVs (BEVs) in its portfolio. By 2030, it projects having more than 75 BEV models in its portfolio, making the company a worthy consideration for those interested in electric car stocks.

Although the company manufactures motor vehicles as its main business, it's also a notable investor in Archer Aviation (ACHR -1.05%). Archer is dedicated to providing customers with a novel option for traveling in urban settings on its electric vertical takeoff and landing aircraft.

In January 2023, Stellantis inked an agreement with Archer to manufacture the company's Midnight aircraft. In addition, Stellantis provided Archer with as much as $150 million in equity capital to access as it sees fit in 2023 and 2024.

Stellantis then announced in March 2024 that it had completed a series of purchases of Archer stock on the open market totaling about 8.3 million shares. Since first investing in Archer in 2021, Stellantis has grown its ownership position in the company significantly. As of February 2025, Stellantis owned about 16% of Archer Aviation's outstanding shares.

How to buy

How to buy Stellantis stock

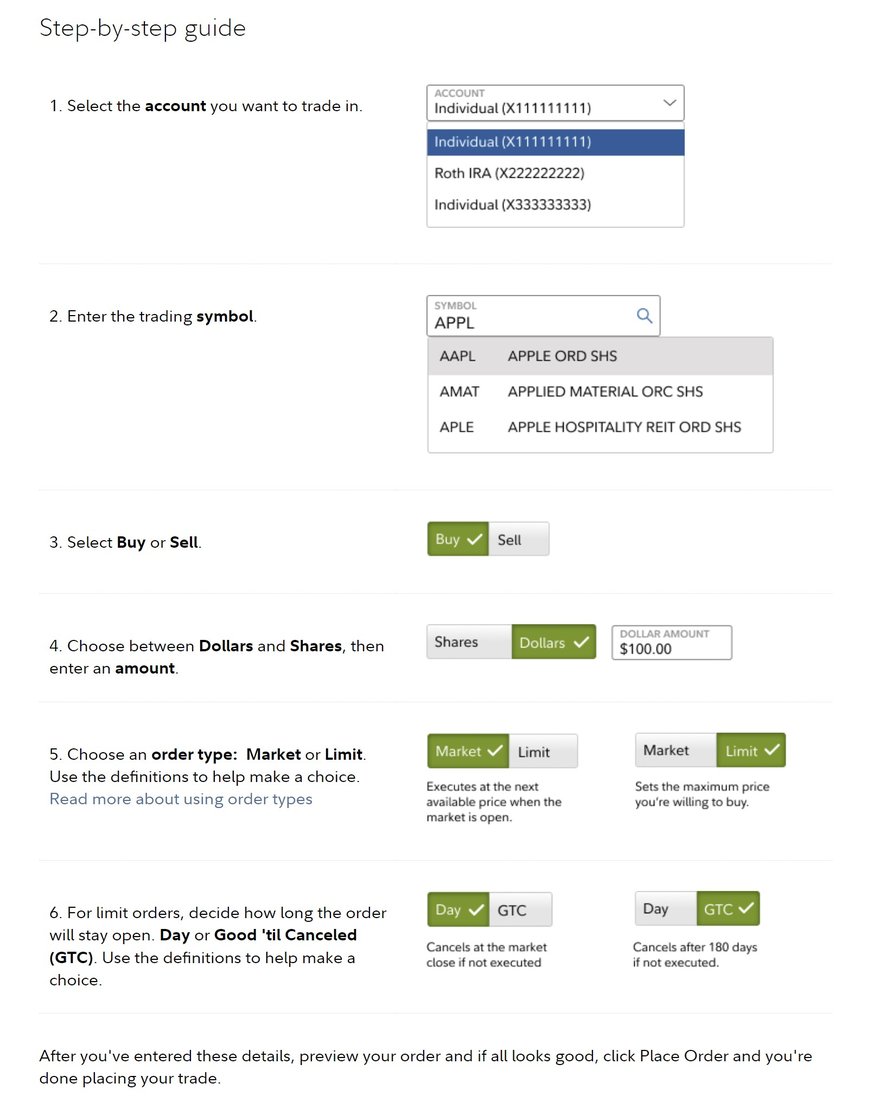

Before you can hitch a ride with Stellantis as an investor, there are some basic steps you need to take to buy stocks.

- Open your brokerage app: Log in to your brokerage account where you handle your investments.

- Search for the stock: Enter the ticker or company name into the search bar to bring up the stock's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.

Should I invest

Should I invest in Stellantis?

Every individual has a unique investing perspective and financial situation. That said, investors may or may not find Stellantis stock appealing for several reasons. Most importantly, investors looking to steer clear of riskier investments will want to think carefully about purchasing Stellantis stock.

After a challenging 2024, when the company recognized significant decreases in revenue and earnings, management announced a plan to get the company back on track. There's no guarantee the company will succeed, so if investors are looking for more conservative routes to gain exposure to carmakers, Stellantis isn't the right choice.

One of the most obvious questions is whether you're interested in a consumer durables stock like Stellantis. Conservative investors or those with shorter investing horizons, for instance, may be less interested in an automaker. Consumer durable stocks tend to be cyclical, so those who are uncomfortable holding Stellantis through downturns should look elsewhere.

Another important consideration is whether you're looking to supplement your passive income. If you're looking for an interesting high-yield dividend stock, Stellantis is worth further investigation, especially since management seems focused on ensuring the company's financial security won't be jeopardized by a high payout.

Of course, it's not only auto investors that will find Stellantis stock alluring. With Stellantis' sizable position in Archer, investors can gain indirect exposure to Archer stock by picking up shares of Stellantis. The fact that Stellantis has signed an agreement to manufacture Archer's aircraft means even more exposure to Archer.

Lastly, if you're interested in an automaker that's embracing the transition to EVs, it's worth considering Stellantis stock in addition to EV pure plays like Tesla (TSLA -5.06%) and Rivian (RIVN -3.48%). Though Stellantis still sells internal combustion engine vehicles, it's expanding its lineup of EVs in the coming year. And while the company may represent less of a growth opportunity than Tesla and Rivian, it still stands to benefit from the growing demand for EVs worldwide.

Profitability

Is Stellantis profitable?

For several years, Stellantis had increased profits. In 2024, however, the company hit a pothole. After reporting diluted earnings per share (EPS) of 5.31 euros ($5.82) and 5.94 euros ($6.51) in 2022 and 2023, respectively, the automaker reported diluted EPS of 1.84 euros ($2.02) in 2024.

Declining sales represented the main culprit in the company's inferior performance in 2024 compared to 2023. Stellantis reported only 5.42 million vehicle shipments in 2024, a 12% decrease from the 6.17 million reported in 2023.

Dividends

Does Stellantis pay a dividend?

Stellantis has rewarded investors with a dividend. In 2023 and 2024, for example, it paid dividends per share of 1.34 euros (about $1.45) and 1.55 euros (about $1.68), respectively.

After its poor performance in 2024, management reduced the dividend to ensure the company didn't find itself in poor financial health. For 2025, the company projects it will return 0.68 euros per share (approximately $0.74) to investors.

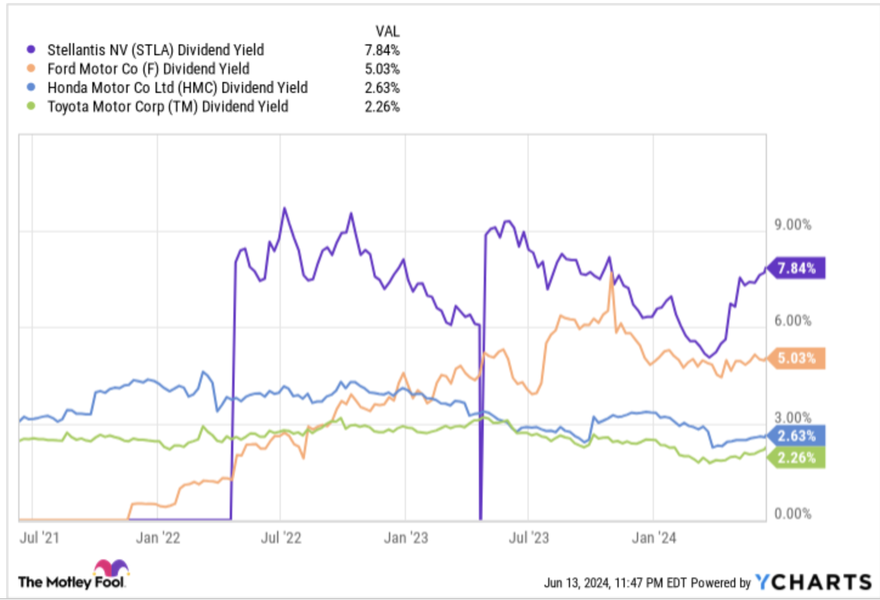

Stellantis has one of the highest dividend yields among automakers, with a forward yield of about 5.6% based on its share price as of February 2025. That's a significantly higher yield than peers like Honda Motor (HMC -0.39%) and Toyota Motor (TM 0.52%) currently pay.

Lest investors fret that the high dividend yield portends poor financial health, the company has articulated a dividend policy that targets a payout ratio between 25% and 30%.

ETF options

ETFs with exposure to Stellantis

If you want broad EV exposure, an exchange-traded fund (ETF) that includes Stellantis among its holdings is a great choice (although there aren't many choices out there). One option is the Global X Autonomous & Electric Vehicles ETF (DRIV -3.2%).

Committed to stocks that provide exposure to autonomous vehicles and EVs, the Global X Autonomous & Electric Vehicles ETF has 74 holdings. Stellantis is among the fund's top 25 holdings, with a 1.35% weighting. The ETF has a total expense ratio of 0.68%, meaning $6.80 of a $1,000 investment goes toward fees.

If you're more interested in Stellantis as a potential source of passive income and care less about EV exposure, the Franklin International Low Volatility High Dividend Index ETF (LVHI -0.23%) is worth considering. The fund focuses on the stocks of foreign companies with high dividend yields and low price and earnings volatility. It has 140 holdings and net assets of over $1.9 billion.

Stellantis represents one of the larger equity positions, with a 1.9% weighting. The ETF has a 0.40% expense ratio, which amounts to $4.00 in fees on a $1,000 investment.

Stock splits

Will Stellantis stock split?

Since the completion of the merger in 2021 that created Stellantis as it is today, the company has not split its stock, and there's no indication that it intends to split it anytime soon. Given that many brokers now offer fractional shares of stocks, fewer companies seem inclined to offer stock splits.

Although many stocks split in 2024 and some are scheduled to split in 2025, Stellantis management is unlikely to announce an upcoming split in the near future.

Related investing topics

The bottom line on Stellantis

Since the completion of the FCA and PSA merger, shares of Stellantis have failed to keep pace with the S&P 500 index. But it's important to remember that the company has operated in its post-merger form for just over three years. It's quite possible that this leading global automaker will be a long-term winner for investors.

Whether you're interested in gaining EV exposure, boosting your passive income, or pursuing another goal altogether, Stellantis could be a good choice to park in your portfolio.

FAQ

Investing in Stellantis FAQ

Can you buy stock in Stellantis?

Stellantis is a publicly traded stock on the New York Stock Exchange. Investors can buy the stock using a brokerage account.

Is Stellantis a good stock to invest in?

Since each investor's financial situation is unique, it's impossible to say for certain whether Stellantis is a good stock to buy. Individuals should do their due diligence and then decide whether Stellantis is a good stock for them.

Is Stellantis a good dividend stock?

Between the recent dividend cut and its poor financial performance in 2024, investors looking for reliable passive income will want to consider options other than Stellantis at this point.

Does Stellantis pay dividends?

Stellantis has paid dividends for the past three years, and management seems intent on continuing to reward shareholders with dividends as long as the company remains profitable.