Industrial real estate investment trusts (REITs) own properties crucial to the industrial sector. Manufacturing and logistics companies are increasingly finding they don't need to own their real estate. That's opening the door for industrial REITs to own more properties and helping to drive their growth.

Here's a closer look at the industrial REIT sector, including its advantages and risks and some industrial REITs worth considering.

Overview

Understanding industrial REITs

Industrial companies use many different types of real estate to develop, manufacture, or produce goods and products. They require specialized real estate to support the movement and storage of products and goods. Properties in the sector include:

- Light manufacturing facilities.

- Food manufacturing facilities.

- Temperature-controlled warehouses (e.g., cold-storage facilities).

- Growing facilities and other properties for medical-use cannabis.

- Flex/office space, meaning a combination of office and industrial space like a warehouse or light manufacturing.

- Logistics properties such as warehouses and fulfillment centers.

Industrial REITs lease these properties to tenants under long-term contracts, some as long as 25 years. They'll often rent an entire industrial building to one tenant under a triple net lease structure, making the tenant responsible for covering building insurance, real estate taxes, and maintenance. The agreements supply the REIT with steady cash flow.

Advantages

Advantages of investing in industrial REITs

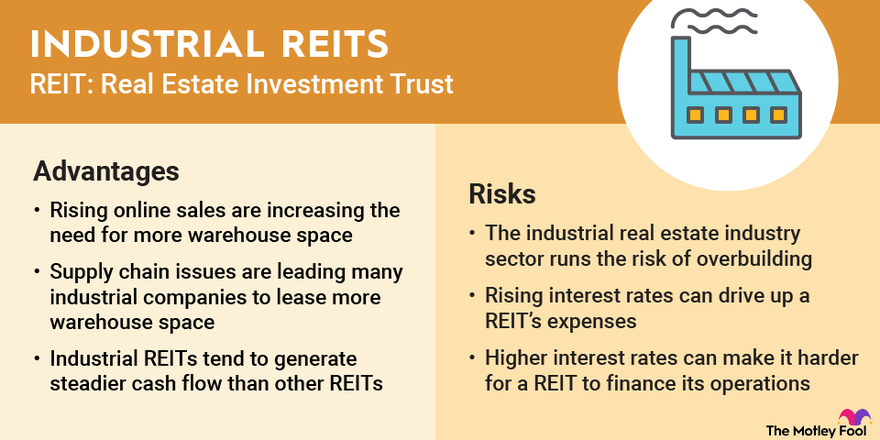

Industrial REITs benefit from several significant demand drivers. Rising online sales are increasing the need for more warehouse space. Meanwhile, supply chain issues are leading many industrial companies to lease more warehouse space to store additional inventory. Many companies are also bringing manufacturing back to the U.S. because of supply chain issues and other factors. These demand tailwinds drive up occupancy and rental rates while providing industrial REITs with significant expansion opportunities.

Industrial REITs also tend to generate steadier cash flow than other REITs. Their focus on long-term triple net leases makes the sector relatively recession-resistant and keeps operating costs down compared to other types of commercial real estate.

Risks

Risks of investing in industrial REITs

The industrial real estate industry needs to build significant capacity in the coming years to support rising demand. However, the sector runs the risk of overbuilding. Most industrial REITs develop new properties on speculation or without securing a tenant before starting construction. They believe they'll sign a lease before completion. Problems arise if developers build too much speculative capacity in certain markets, which can cause occupancy levels and rental rates to decline.

Industrial REITs also face two risks common to all REITs: interest rates and financing risks. Rising interest rates can drive up a REIT's expenses if they have floating rate debt or significant upcoming maturities.

Higher interest rates can also make it harder for a REIT to finance its operations. If rates rise too much, it can be too expensive for a REIT to fund expansions such as acquisitions and development projects.

Meanwhile, rising interest rates can also weigh on REIT stock prices. Rising rates increase the income yield on lower-risk options such as bonds. As a result, the dividend yield on REITs needs to rise (which happens as their share prices decline) to compensate investors for their higher risk level.

Our list

Five industrial REITs to consider in 2025

According to the National Association of Real Estate Investment Trusts (NAREIT), there were 12 publicly traded industrial REITs in early 2025. Here are a few interesting ones for investors to consider:

| Name and ticker | Market cap | Dividend yield | Industry |

|---|---|---|---|

| Prologis (NYSE:PLD) | $93 billion | 3.88% | Equity Real Estate Investment Trusts (REITs) |

| Rexford Industrial Realty (NYSE:REXR) | $7 billion | 5.15% | Equity Real Estate Investment Trusts (REITs) |

| Americold Realty Trust (NYSE:COLD) | $6 billion | 4.54% | Equity Real Estate Investment Trusts (REITs) |

| Stag Industrial (NYSE:STAG) | $6 billion | 4.56% | Equity Real Estate Investment Trusts (REITs) |

| Innovative Industrial Properties (NYSE:IIPR) | $1 billion | 14.91% | Equity Real Estate Investment Trusts (REITs) |

1 - 2

1. Prologis

Prologis is the largest industrial REIT by a wide margin and one of the largest REITs overall. Entering 2025, the company had investments in almost 5,900 buildings encompassing roughly 1.3 billion square feet of space leased to about 6,500 tenants. The company has a global logistics business with operations in 20 countries.

Prologis stands out from other logistics-focused industrial REITs. It has a global reach; most rivals typically emphasize the U.S. market. Prologis also has an investment management platform, enabling it to earn management fees in addition to rental income. Finally, it has a global development platform, which enhances its growth prospects. These differences have enabled Prologis to grow faster than other logistics REITs over the years.

2. Americold Realty Trust

Americold Realty Trust is one of two publicly traded REITs focused on cold-storage properties. As of early 2025, the company owned and operated almost 240 temperature-controlled warehouses with about 1.4 billion cubic feet of storage worldwide. Americold leases space in its facilities to food manufacturers, distributors, and retailers. The REIT also manages third-party-owned facilities and provides transportation services.

Americold has been a serial acquirer, enabling it to build the world's second-largest portfolio of temperature-controlled warehouses. Its scale provides it with additional growth opportunities, including acquiring cold-storage facilities and building new ones to support its customers.

3 - 5

3. STAG Industrial

STAG Industrial owns a diversified portfolio of industrial real estate. It had more than 590 buildings exceeding 115 million square feet of space in early 2025, including warehouses, light manufacturing, and flex/office space. It leases its buildings to single tenants under triple net leases. STAG is also highly diversified by tenant, market, and industry.

Aside from its diversification, two factors make STAG stand out from other REITs. First, it's one of the few REITs that pays a monthly dividend. Meanwhile, it doesn't have a development platform. Instead, the REIT primarily grows by acquiring additional properties. It purchases many properties with the intention of adding value through leasing, expansion, and development opportunities.

4. Innovative Industrial Properties

Innovative Industrial Properties focuses on owning specialized industrial properties leased to state-licensed cannabis operators. As of early 2025, the company owned almost 100 properties with 9 million square feet of space leased to 31 tenants across 19 states.

Innovative Industrial Properties helps provide capital to the cannabis sector. It completes sale-leaseback transactions to acquire dispensaries, cultivation facilities, processing facilities, manufacturing facilities, and other properties that it leases back to regulated operators, giving them the capital to continue expanding their operations.

5. Rexford Industrial Realty

Rexford Industrial is a pure-play industrial REIT focused solely on the Southern California industrial market. It's one of the largest markets in the world, benefitting from high demand, low supply, and high barriers to entry. Those market conditions keep occupancy levels high, driving healthy rental growth rates.

The REIT owns 425 properties in Southern California with 51 million square feet of space leased to more than 1,600 customers. It steadily expands its portfolio by acquiring new properties, often with the purpose of adding additional value through leasing, expansion, or redevelopment.

Related investing topics

Many different industrial REIT options

Industrial real estate covers a lot of ground, so many industrial REITs focus on a specific property type. That gives investors a wide variety of ways to invest in the sector.