Many investors focus their attention on how a stock's price changes over time. However, when talking about dividend-paying stocks, that doesn't even begin to tell the entire story.

For example, let's say JPMorgan Chase (JPM -1.47%) was trading for roughly $150 per share three years ago and is currently trading at around $240 per share. It may sound like investors who bought the stock made $90 per share over the three-year period.

However, if I tell you Verizon (VZ -1.85%) also paid its shareholders about $14 per share in dividends over the past three years, that changes the story a little. Instead of the $90 capital gain per share, which translates to 60%, investors actually made significantly more when accounting for dividends paid.

Total return considers both capital gains and dividends for a complete picture of a stock's performance over a specified time. This can be extremely useful for evaluating investment returns among dividend stocks, comparing the performance of dividend stocks to those without dividends or other distributions, and comparing investment results when stocks are held for different lengths of time.

What they are

What are total returns?

Simply put, an investment's total return is its overall return from all sources, such as capital gains, dividends, and other distributions to shareholders. As a basic example, a stock that paid a 5% dividend yield relative to its purchase price and increased in value by 5% over the first year you owned it would have produced a total return of 10% over the one-year period.

Total returns can be calculated as a dollar amount or as a percentage. In other words, you can say a stock's total return is $8 per share over a certain one-year period or that its total return was 11%. The best way to express total return depends on the context you're using it for, as we'll see throughout the rest of this discussion.

Total return can also be expressed on an overall basis or over specified time intervals. If you held a stock for several years, it might be useful to know its overall total return during your holding period.

Alternatively, knowing your total return on an annualized basis could help you compare the results of that investment with those of others you own or with the stock market as a whole. In later sections, we'll discuss the actual calculation methods and provide some examples.

Why they matter

Why are total returns important?

Total return allows you to see the big picture when it comes to how well (or poorly) an investment is actually doing, not just how its share price is performing. Many stock investments, in particular, are designed to produce a combination of income and capital gains. Total return combines these two types of investment returns into a single metric.

Many investors make the mistake of focusing only on how much their stocks move up and down, often ignoring other ways their investments have generated returns in their portfolio, particularly dividends. Similarly, many income-focused investors often judge their investments primarily on the dividends paid and don't pay enough attention to share-price movements.

Total return can be highly useful when you're assessing the performance of your investments and comparing their performance to each other or to the overall stock market.

Important terms

Important terms investors should know

To truly understand total returns and how to use them effectively, there are a few other investment terms and concepts you should know. Knowing these will also help you become a more well-rounded investor. Here are just a few.

Annualized return

Your annualized return is an investment return expressed on a yearly basis. For instance, if you have one investment that produced a 20% total return in three years and another that produced a 35% total return in five years, it can be difficult at first glance to determine which was the better investment.

We'll get into the calculation of annualized total returns later. The point is that it can be a more apples-to-apples comparison to see investment returns expressed on an annualized (i.e., yearly) basis, especially if they were held for different periods.

Simple returns

There are two ways to express investment returns over time: simple and compound. A simple return (or simple interest) is a rate of return based on the principal (i.e., the original investment amount) year after year.

This is often used in the context of fixed-income (bond) investments. For example, if a bond costs $1,000 and yields 5%, that is a form of simple return -- in other words, 5% of the original cost, or $50, will be paid to the bondholder every year until maturity.

Compound returns

A compound return (or compound interest) is a return that is paid on the principal and any accumulated returns that have already been paid. Annualized total return is a form of compound return.

As a simplified example to illustrate compound returns, consider an investment that generates a 10% annualized total return. If you invest $1,000, you can expect to have $1,100 by the end of the first year. For the second year, however, the 10% would be added to the $1,100, not the original $1,000. So, you'd end up with $1,210 at the end of the second year.

Compounding frequency

The method most often used to calculate total returns is annual compounding. That's what the formula I will discuss in the next section will do.

However, other compounding intervals are possible when computing returns and interest charges in finance. For example, your bank probably compounds your interest daily or monthly on your savings account. Other intervals, like quarterly, weekly, or semiannual compounding, are also possible.

To give you just an idea of how this works, a $1,000 investment that generates 10% total returns compounded semiannually would be worth $1,050 after six months. After another six months, a 5% (half of the annual return) gain would be added, which would make it $1,102.50.

Dividend reinvestment/DRIP

To maximize the total returns of a long-term investment, dividend reinvestment is an essential step. This means that when your stocks pay you dividends, you use those dividend payments to buy additional shares of the same stock.

With most brokers, you can enroll your stocks in a dividend reinvestment plan (DRIP) that will do this automatically and without any additional trading commissions. If you're a long-term investor, enrolling in a DRIP can help you maximize your total returns, and it can make more of a difference than you might think over long periods.

Internal rate of return (IRR)

Internal rate of return (IRR) is similar in concept to total return. However, it involves a more complicated calculation.

Aside from its complexity, the biggest difference between IRR and total return is that IRR is a forward-looking metric that incorporates things like projected dividends or distributions, future profitability, and more. This is more commonly used when talking about real estate investments, but it can also be applied to stocks when trying to project long-term returns from different prospective investments.

Expected total return

Expected total return is the same calculation as total return but using future assumptions instead of actual investment results. For example, if you predict that a stock trading for $30 will rise to $33 over the next year while paying $2 in dividends, your expected total return is $5 per share or 16.7%.

Obviously, nobody has a crystal ball that can predict stock performance, and an investment's past performance doesn't guarantee its future results. That said, projections can still be a valuable tool when analyzing opportunities, so using the information you have to calculate the expected total return can help you get an idea of the future potential of certain investment opportunities.

Risk-adjusted return

This uses the risk-free rate of return and investment volatility to account for an investment's risk level when calculating returns. A basic investment goal is to maximize the amount of return produced by investments relative to the total risk. In other words, a lower return from a low-risk investment can be a better risk-adjusted return than a superior return produced by a higher-risk investment.

One popular way to assess risk-adjusted returns is with a metric called the Sharpe ratio. This not-too-complicated metric subtracts the risk-free rate of return from an investment's actual return and then divides it by the standard deviation (volatility) of that return.

Unrealized versus realized capital gains

An unrealized capital gain refers to a stock or other investment that has increased in value since you bought it but that you still own. In other words, if you paid $5,000 for a stock investment that is now worth $6,000, you can't spend that $1,000 of profit until you sell. Once you sell an appreciated investment, it is then referred to as a realized capital gain. This is an important concept in the context of total returns.

Calculation

How to calculate total return for a stock investment

Now, we'll go through the process of calculating total returns. There are a few ways to calculate total return depending on the exact form of the metric you're looking for, but the good news is that none of them are particularly complex.

To determine an investment's overall total return, follow these steps:

- First, determine how much capital gains it has produced since you bought it. For instance, if you paid $50 for a stock that's now trading for $60, your capital gain is $10 per share.

- Second, you need to add up the dividends and other distributions the investment has paid over your entire holding period. Adding this figure to your capital gains will give you the investment's total return in dollars.

- Third, to express total return as a percentage, which is generally more useful, simply take the dollar amount of total return you calculated, divide it by the price you paid for the investment, and multiply the result by 100.

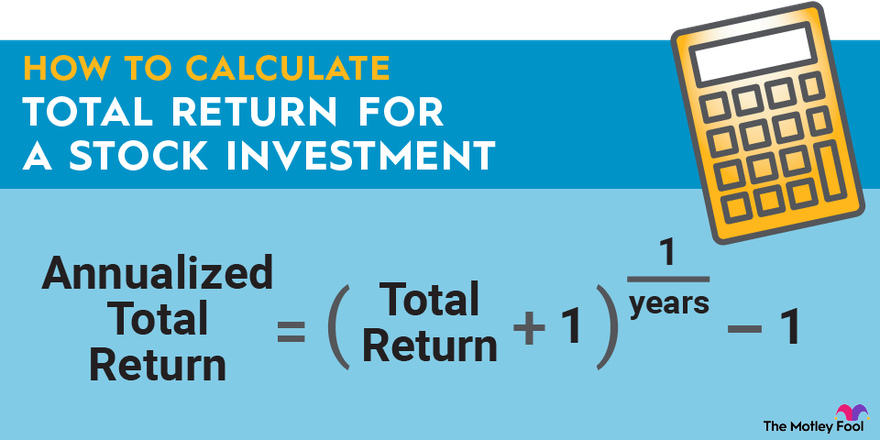

- Finally, to annualize the total return, you'll need a bit more complicated math. Take the percentage total return you found in the previous step (written as a decimal) and add 1. Then, raise this to the power of 1 divided by the number of years you held the investment. Finally, subtract 1. In mathematical form, this looks like:

This formula assumes annual compounding, which keeps the calculation as uncomplicated as possible. Other methods, such as continuous or monthly compounding, are also available, but this method is generally sufficient for calculating and comparing investment returns.

Example

A real-world example

That last part may sound a bit confusing, especially when calculating annualized total returns, so let's look at a step-by-step real-world example. Let's say you bought shares of Bank of America (BAC -1.7%) stock on Jan. 2, 2020, and sold them on Jan. 2, 2025. Now, you want to determine your total return on your investment. Before we start, here's the information you need to know:

- You bought shares for $35.50.

- Two years later, you sold those shares for $44.50.

- Over the five-year holding period, Bank of America paid 20 quarterly dividends, which added up to $4.04.

Let's review the three total return calculations I discussed in the last section. First, your overall total return. Your capital gain on each share was $44.50 minus $35.50, or $9.00 per share. Adding the $4.04 in dividends you received shows a total return of $13.04 per share on your investment.

Second, to convert this total return to a percentage, you need to divide the $13.04 total return by the purchase price for each share, or $35.50, and then multiply by 100. This gives you a total return of 36.7% over five years.

Finally, to calculate your annualized total return, you need to use the formula from the last section. When you do, you'll get an annualized total return of about 6.5%.

Reinvested dividends

Total return with reinvested dividends

Now, it's worth mentioning that if you're reinvesting your dividends as you go -- which I absolutely recommend long-term investors do -- the calculation gets a bit more complicated. Essentially, each reinvestment becomes its own return calculation, including the capital gains generated from the newly purchased shares.

Calculating total returns with reinvested dividends is difficult using the previously discussed method. After all, you'll buy new shares at whatever price they're trading for as of the dividend payment date, and you'll end up with more shares than you started with, and then those shares will begin to pay you dividends as well. So, what's the solution?

The total return calculation with reinvested dividends can be simplified by looking at the investment on an overall value (as opposed to a per-share) basis. Consider our Bank of America example from the previous section. Let's say that you invested $10,000 in the stock and that after five years of reinvesting your dividends, your investment is now worth $14,160 -- a 41.6% total return (or 0.416 in decimal form).

Using our formula for annualized total return, we see that your total return with reinvested dividends is about 7.2% per year, which is significantly higher. So, by reinvesting your dividends, you achieved a slightly better total return than you would have by simply collecting the dividends paid by the stock.

How to use

How to use total return calculations in your investment strategy

There are a few practical uses for the concept of total return. As I've mentioned, total return is a good way to compare the performance of various investments over time. For example, let's say you own five stocks in your portfolio and have invested $1,000 in each one. Some don't pay dividends at all, and those that do pay varying amounts.

At first glance, it can be difficult to determine which of these stocks was the best performer over any multiyear period, especially if you don't automatically reinvest your dividends and just receive the payments in cash in your brokerage account. This is where total return comes in -- it can give you a single number that sums up the performance of each investment.

From a strategy perspective, evaluating expected total returns from your investments can be useful when making decisions. As a personal example, I'm a big fan of real estate investment trusts (REITs), which are specifically designed to be total-return investments with a nice combination of income and capital gain.

By assessing one of these stocks' track records of total returns and determining whether the company's business composition has changed, I can compare total return potential when screening prospective investments.

Related investing topics

The bottom line on total return

Total return is a great metric to add to your investment knowledge. Some investments are designed to produce a great deal of capital appreciation, while others are intended to produce income. Total return combines these two types of investment performance into a single metric.

Knowing how to calculate and apply total return can help you evaluate the overall performance of different stocks, compare different potential investments, and understand the value of dividend reinvestment, to name just a few things.